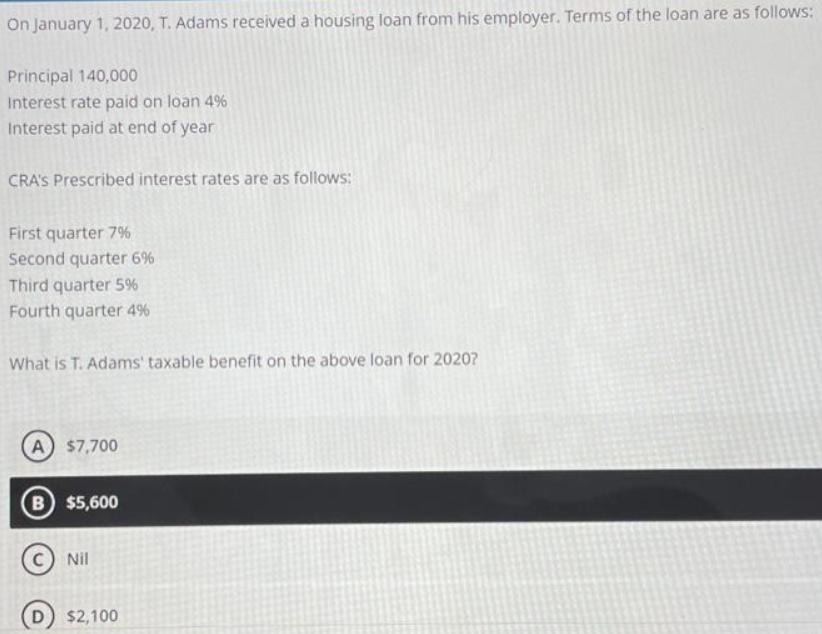

Question: On January 1, 2020, T. Adams received a housing loan from his employer. Terms of the loan are as follows: Principal 140,000 Interest rate

On January 1, 2020, T. Adams received a housing loan from his employer. Terms of the loan are as follows: Principal 140,000 Interest rate paid on loan 4% Interest paid at end of year CRA'S Prescribed interest rates are as follows: First quarter 7% Second quarter 6% Third quarter 5% Fourth quarter 4% What is T. Adams' taxable benefit on the above loan for 2020? A $7,700 B $5,600 Nil D) $2,100

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Principal 140000 Interest paid 4 Interest amount 5... View full answer

Get step-by-step solutions from verified subject matter experts