Question: You tind numerous errors in the inventory system that affected net income in prior years. Assume taxes are 40%. Vear 1 is the first

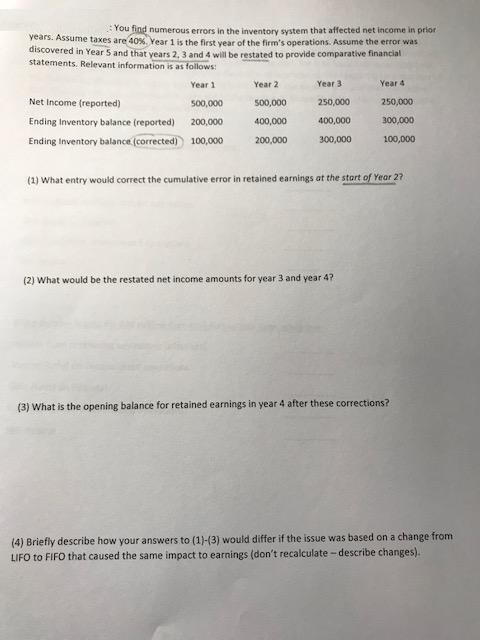

You tind numerous errors in the inventory system that affected net income in prior years. Assume taxes are 40%. Vear 1 is the first vear of the firm's operations. Assume the error was discovered in Year 5 and that years 2, 3 and 4 will be restated to provide comparative financial statements. Relevant information is as follows: Year 1 Year 2 Year 3 Year 4 Net Income (reported) 500,000 500,000 250,000 250,000 Ending Inventory balance (reported) 200,000 400,000 400,000 300,000 Ending Inventory balance (corrected) 100,000 100,000 200,000 300,000 (1) What entry would correct the cumulative error in retained earnings at the stort of Year 27 (2) What would be the restated net income amounts for year 3 and year 4? (3) What is the opening balance for retained earnings in year 4 after these corrections? (4) Briefly describe how your answers to (1)-(3) would differ if the issue was based on a change from LIFO to FIFO that caused the same impact to earnings (don't recalculate - describe changes).

Step by Step Solution

3.57 Rating (157 Votes )

There are 3 Steps involved in it

1 The journal entry that would correct the cumulative error in retained earnings at the start of yea... View full answer

Get step-by-step solutions from verified subject matter experts