Question: On January 1, 2020, Yoyo acquired a computer system at a cost of $160,000. Estimated useful life is four years, with residual value of

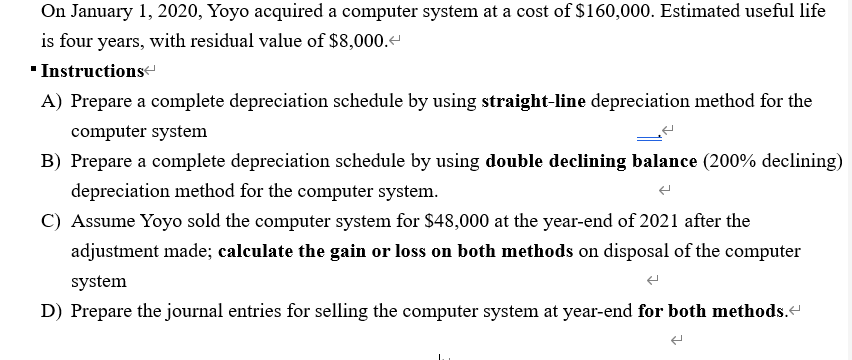

On January 1, 2020, Yoyo acquired a computer system at a cost of $160,000. Estimated useful life is four years, with residual value of $8,000. " Instructions A) Prepare a complete depreciation schedule by using straight-line depreciation method for the computer system B) Prepare a complete depreciation schedule by using double declining balance (200% declining) depreciation method for the computer system. C) Assume Yoyo sold the computer system for $48,000 at the year-end of 2021 after the adjustment made; calculate the gain or loss on both methods on disposal of the computer system D) Prepare the journal entries for selling the computer system at year-end for both methods.

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts