On January 1, 2025, Crane, Inc. signs a 10-year noncancelable lease agreement to lease a storage...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

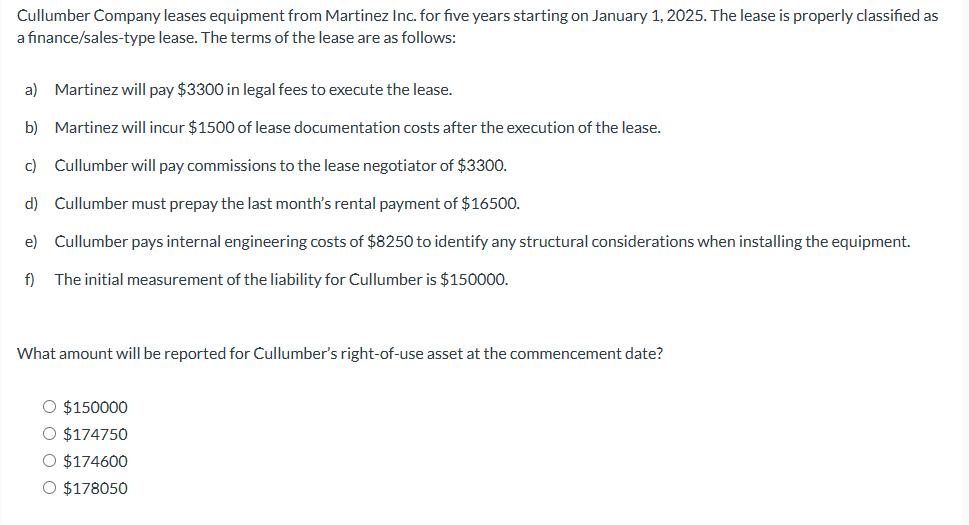

On January 1, 2025, Crane, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Monty Warehouse Company. Collectibility of the lease payments is reasonably predictable and no important uncertainties surround the costs yet to be incurred by the lessor. The following information pertains to this lease agreement: (a) The agreement requires equal rental payments at the beginning of each year. (b) The fair value of the building on January 1, 2025 is $5950000; however, the book value to Monty is $4900000. (c) The building has an estimated economic life of 10 years, with no residual value. Crane depreciates similar buildings using the straight-line method. (d) At the termination of the lease, the title to the building will be transferred to the lessee. (e) Crane's incremental borrowing rate is 10% per year. Monty Warehouse Co. set the annual rental to ensure a 8% rate of return. The implicit rate of the lessor is known by Crane, Inc. (f) In addition to the payments for the use of the leased asset, the lessor also requires the lessee to pay a yearly payment of $14900 of executory costs related to taxes on the property.. Click here to view factor tables. From the lessee's viewpoint, what will be recorded as Right-of-Use Asset amount? (Round factor value calculation to 5 decimal places, e.g. 1.25124. and round intermediate calculation to O decimal places.) Cullumber Company leases equipment from Martinez Inc. for five years starting on January 1, 2025. The lease is properly classified as a finance/sales-type lease. The terms of the lease are as follows: a) Martinez will pay $3300 in legal fees to execute the lease. b) Martinez will incur $1500 of lease documentation costs after the execution of the lease. c) Cullumber will pay commissions to the lease negotiator of $3300. d) Cullumber must prepay the last month's rental payment of $16500. e) Cullumber pays internal engineering costs of $8250 to identify any structural considerations when installing the equipment. f) The initial measurement of the liability for Cullumber is $150000. What amount will be reported for Cullumber's right-of-use asset at the commencement date? $150000 O $174750 $174600 $178050 On January 1, 2025, Crane, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Monty Warehouse Company. Collectibility of the lease payments is reasonably predictable and no important uncertainties surround the costs yet to be incurred by the lessor. The following information pertains to this lease agreement: (a) The agreement requires equal rental payments at the beginning of each year. (b) The fair value of the building on January 1, 2025 is $5950000; however, the book value to Monty is $4900000. (c) The building has an estimated economic life of 10 years, with no residual value. Crane depreciates similar buildings using the straight-line method. (d) At the termination of the lease, the title to the building will be transferred to the lessee. (e) Crane's incremental borrowing rate is 10% per year. Monty Warehouse Co. set the annual rental to ensure a 8% rate of return. The implicit rate of the lessor is known by Crane, Inc. (f) In addition to the payments for the use of the leased asset, the lessor also requires the lessee to pay a yearly payment of $14900 of executory costs related to taxes on the property.. Click here to view factor tables. From the lessee's viewpoint, what will be recorded as Right-of-Use Asset amount? (Round factor value calculation to 5 decimal places, e.g. 1.25124. and round intermediate calculation to O decimal places.) Cullumber Company leases equipment from Martinez Inc. for five years starting on January 1, 2025. The lease is properly classified as a finance/sales-type lease. The terms of the lease are as follows: a) Martinez will pay $3300 in legal fees to execute the lease. b) Martinez will incur $1500 of lease documentation costs after the execution of the lease. c) Cullumber will pay commissions to the lease negotiator of $3300. d) Cullumber must prepay the last month's rental payment of $16500. e) Cullumber pays internal engineering costs of $8250 to identify any structural considerations when installing the equipment. f) The initial measurement of the liability for Cullumber is $150000. What amount will be reported for Cullumber's right-of-use asset at the commencement date? $150000 O $174750 $174600 $178050

Expert Answer:

Related Book For

Posted Date:

Students also viewed these accounting questions

-

Sketch the vector-valued function r(t) = (sin(2t), t, 3 cos(2t)), indicating direction. Z y X

-

On January 1, 2015, Yancey, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company. Collectibility of lease payments is reasonably predictable and...

-

Your restaurant has five menu choices for lunch. How many ways can you order them on your menu? A 0.0749 B 0.0747 120

-

Home and Foreign both produce cars and food using labor and capital. In each country, both labor and capital are freely mobile across industries. It takes 5 units of labor and 3 units of capital to...

-

On the Internet, you will find a case history about a "Gas Station Fire." Describe the incident and make recommendations to prevent this type of incident.

-

A parallel-plate capacitor with air between its plates carries a charge of \(6.60 \mu \mathrm{C}\) when a \(9.00-\mathrm{V}\) battery is connected to it. How much energy is stored in the capacitor?

-

Jack Kanet Manufacturing produces custom-built pollution control devices for medium.-size steel mills. The most recent project undertaken by Jack requires 14 different activities. (a) Jacks managers...

-

15. 16. What is the final product (major) 'A' in the given reaction? CH3 OH CH CH3 HCI + 'A' (major product) CH3 CH3 Cl CH (B) CH3 CH2-CH3 (A) CH3 CH (C) shiks CH=CH2 (D) Which of the following...

-

In the below chemical reaction, list 5 ways to increase the amount of nitrogen gas. 3H 2 (g) + N 2 (g) --> 2NH 3 (g) H rxn = -92.2kJ/mol

-

2) You are pulling your friend (52 kg) on a sled (4 kg) with a force of 12 N as shown in the figure. Find the acceleration produced by your applied force. L # 50

-

Every summer, thousands of bikers converge in Copenhagen, filling up every campground, motel, and hotel within miles of the city to celebrate the opening of the Bakken oldest theme park. This annual...

-

Find the area between the curves. x = -2, x = 1, y = x, y=x - 2 The area between the curves is. (Type an integer or an improper fraction. Simplify your answer.)

-

Define business ethics and its significance in corporate decision - making. Discuss the impact of ethical behavior on a company's reputation and long - term success.

-

An arrow is shot straight up in the air at an initial speed of 23.0 m/s. After how much time is the arrow heading downward at a speed of 4.00 m/s? S

-

Compute the income of the following: 1. Brandy graduated from Vanderbilt with her bachelor's degree recently. She works for Walton & Company CPAs. The firm pays her tuition ($8,000 per year) for...

-

Propose a reasonable mechanism for the following reaction. OH

-

A significance level of 0.05 indicates that the probability of making a type I error is 0.05.

-

A handy mnemonic for interpreting the P-value in a hypothesis test is this: If the P (value) is low, then the null must go.

-

In testing a claim about a population mean, a larger z test statistic always results in a larger P-value. Decide whether the statement makes sense (or is clearly true) or does not make sense (or is...

Study smarter with the SolutionInn App