Question: On March 1, 2018, St. Lucy Ltd acquired a machine from Machinery Suppliers under the following terms: List price of machine Import duty Delivery

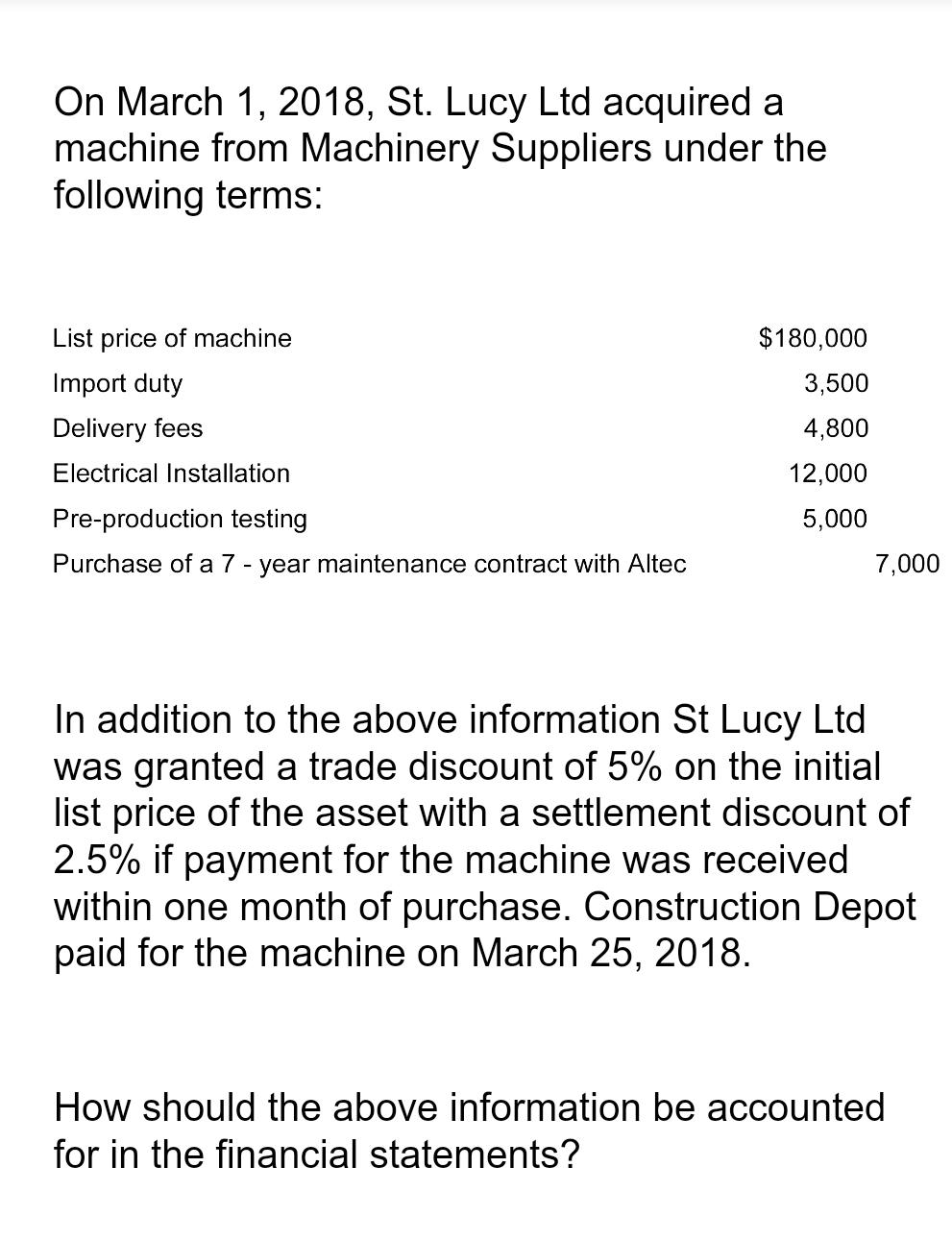

On March 1, 2018, St. Lucy Ltd acquired a machine from Machinery Suppliers under the following terms: List price of machine Import duty Delivery fees Electrical Installation Pre-production testing Purchase of a 7 - year maintenance contract with Altec $180,000 3,500 4,800 12,000 5,000 7,000 In addition to the above information St Lucy Ltd was granted a trade discount of 5% on the initial list price of the asset with a settlement discount of 2.5% if payment for the machine was received within one month of purchase. Construction Depot paid for the machine on March 25, 2018. How should the above information be accounted for in the financial statements?

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

To account for the above information in the financial statements we need to calculate the total cost of the machine that St Lucy Ltd acquired and then ... View full answer

Get step-by-step solutions from verified subject matter experts