Question: ones outlined in red wrong. please help Shown below are comparative balance sheets for Pearl Industries Pearl Industries Comparative Balance Sheets December 31 Assets 2022

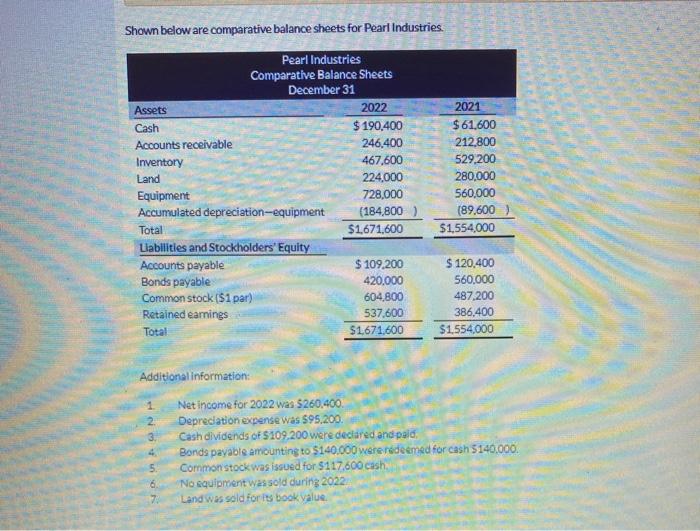

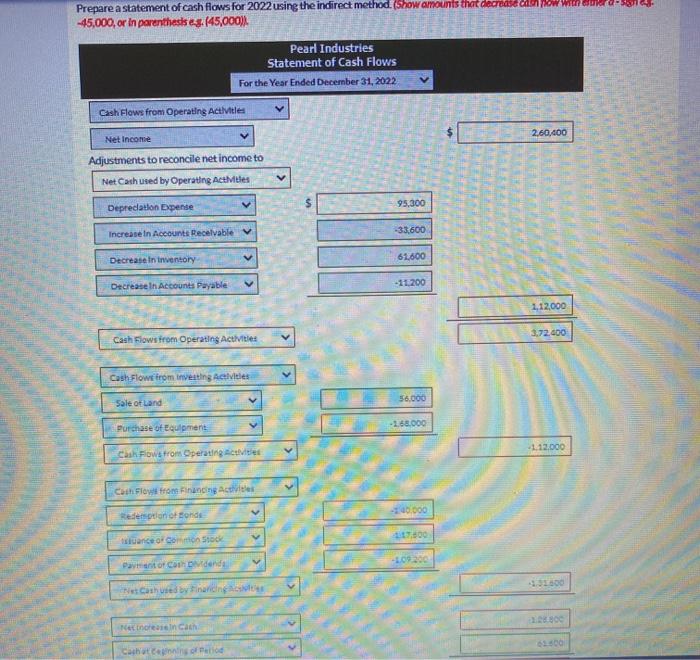

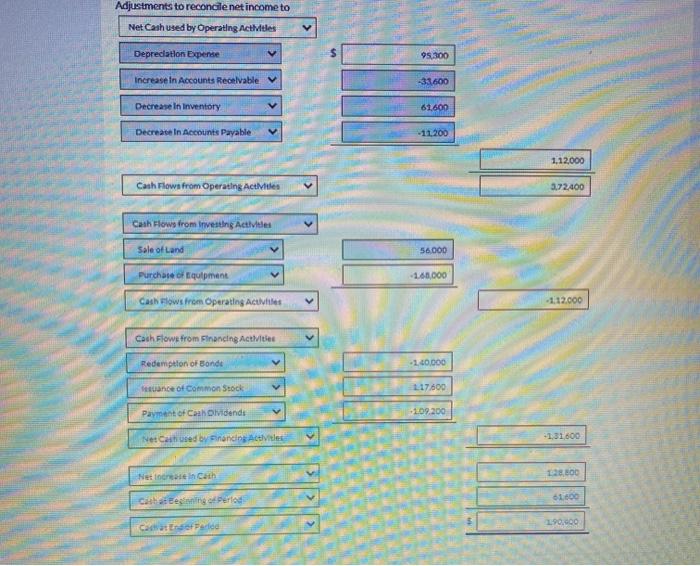

Shown below are comparative balance sheets for Pearl Industries Pearl Industries Comparative Balance Sheets December 31 Assets 2022 Cash $190.400 Accounts receivable 246,400 Inventory 467,600 Land 224,000 Equipment 728,000 Accumulated depreciation-equipment (184,800 Total $1,671,600 Liabilities and Stockholders' Equity Accounts payable $ 109,200 Bonds payable 420.000 Common stock (51 par) 604,800 Retained eamings 537,600 Total $1,671,600 2021 $ 61,600 212.800 529,200 280,000 560,000 (89,600) $1,554,000 $ 120.400 560.000 487,200 386,400 $1,554,000 Additional information: Net income for 2022 was $260,400. Depreciation expense was 595,200 Cash dividends of $109,200 were declared and paio Bonds payable amounting to $140.000 were redeemed for cash 5140,000 5. Common stock was issued for $117.600 cash 8. No equipment was sold during 2022 7 Land was sold for its book value. Prepare a statement of cash flows for 2022 using the indirect method. (Show amounts that decreased without -45,000, or in parenthesis es (45,000), Pearl Industries Statement of Cash Flows For the Year Ended December 31, 2022 Cash Flows from Operating Activities 2.60,400 Net Income Adjustments to reconcile net income to Net Cash used by Operating Actitles $ 95,300 Deprecation Expense Increase in Accounts Recevable -33,600 Decrease in inventory 61.600 Decrease in Accounts Payable -11.200 1,12,000 3.72.400 Cash Flows from Operating Activities Cash Flow from investing Activities Sale of Land 56.000 Purchase of equipment -2.68.000 1.12.000 Cash Flows from Operating cities Cash Flooding Acties 300.000 Redemption of sonde suance of cortion Stock 1.09 200 Payment of Comidonda NetCathed by Financing Mer increason Cach Caching of Patio Adjustments to reconcile net income to Net Cash used by Operating Activities Depreciation Expense 95.300 Increase in Accounts Recevable -33.600 Decrease in Inventory 61,600 Decrease in Accounts Payable -11.200 1,12,000 Cash Flows from Operating Activities 3.72,400 Cash Flows from Investing Activities Sale of Land 56.000 Purchase of equipment 160,000 Cash Flows from Operating Activities -112.000 Cash Flows from Financing Activities Redemption of Bonde 140.000 tance of Common Stock V 117,600 Payment of Caah olvidends 1.09.200 NetCated by ending Activitet -1,31600 Nettete in Cath 61.600 Cash Bening of Pero 190.000 carattere

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts