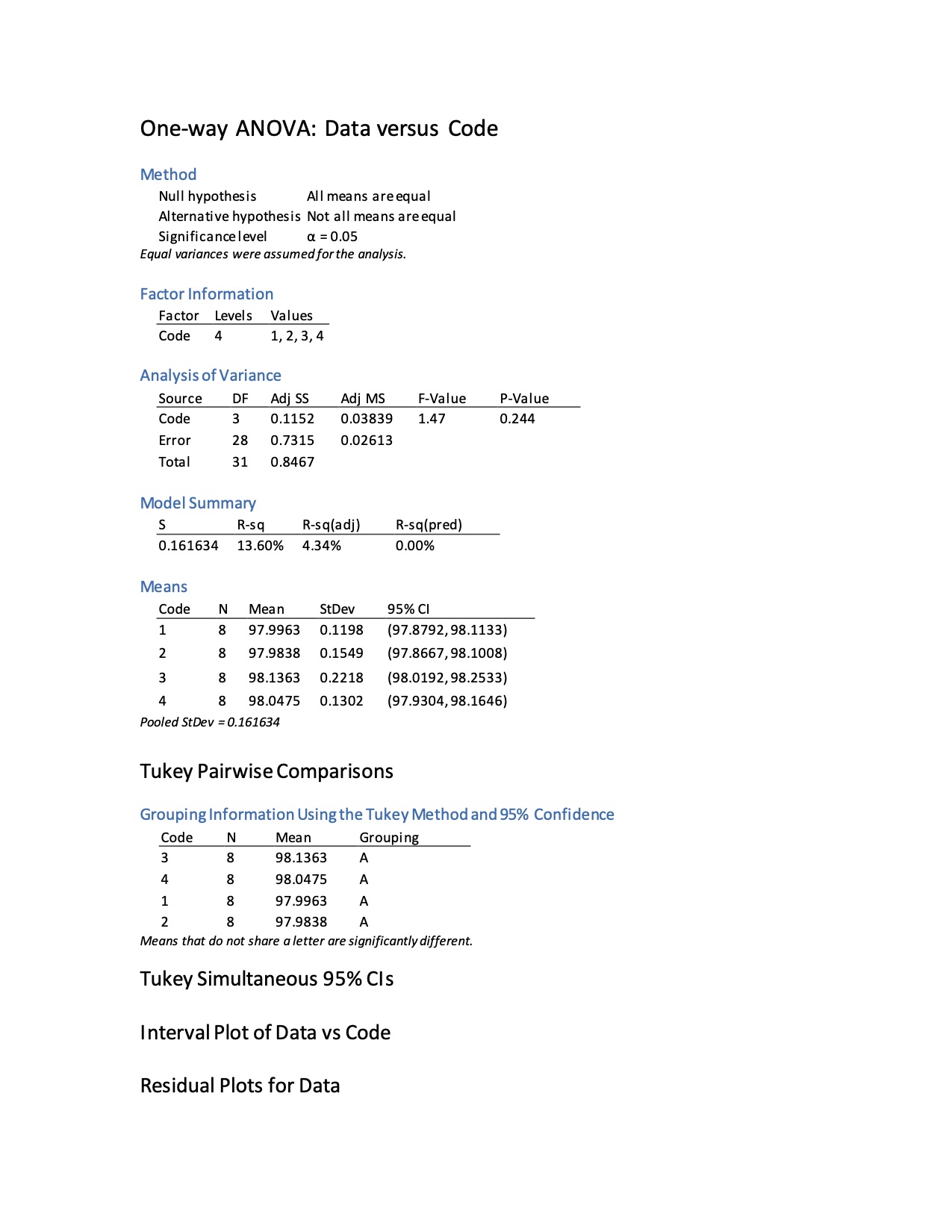

Question: One-way ANOVA: Data versus Code Method Null hypothesis All means are equal Alternative hypothesis Not all means are equal Significance leve a = 0.05 Equal

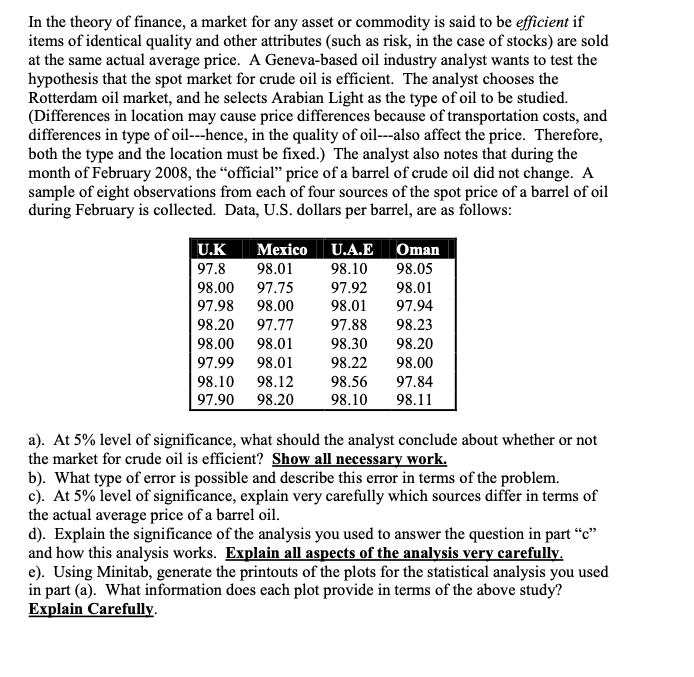

One-way ANOVA: Data versus Code Method Null hypothesis All means are equal Alternative hypothesis Not all means are equal Significance leve a = 0.05 Equal variances were assumed for the analysis. Factor Information Factor Levels Values Code 4 1, 2, 3, 4 Analysis of Variance Source DF Adj SS Adj MS F-Value P-Value Code 3 0.1152 0.03839 1.47 0.244 Error 28 0.7315 0.02613 31 0.8467 Model Summary S R-sq R-sq(adj) R-sq(pred) 0.161634 13.60% 4.34% 0.00% Means Code N Mean StDev 95% CI 1 8 97.9963 0.1198 (97.8792, 98.1133) 2 8 97.9838 0.1549 (97.8667, 98.1008) - W 8 98.1363 0.2218 (98.0192, 98.2533) 8 98.0475 0.1302 (97.9304, 98.1646) Pooled StDev = 0.161634 Tukey Pairwise Comparisons Grouping Information Using the Tukey Method and 95% Confidence Code N Mean Grouping 3 98.1363 A A 00 00 98.0475 A A N 97.9963 97.9838 A Means that do not share a letter are significantly different. Tukey Simultaneous 95% Cls Interval Plot of Data vs Code Residual Plots for DataIn the theory of finance, a market for any asset or commodity is said to be efficient if items of identical quality and other attributes (such as risk, in the case of stocks) are sold at the same actual average price. A Geneva-based oil industry analyst wants to test the hypothesis that the spot market for crude oil is efficient. The analyst chooses the Rotterdam oil market, and he selects Arabian Light as the type of oil to be studied. (Differences in location may cause price differences because of transportation costs, and differences in type of oil---hence, in the quality of oil---also affect the price. Therefore, both the type and the location must be fixed.) The analyst also notes that during the month of February 2008, the "official" price of a barrel of crude oil did not change. A sample of eight observations from each of four sources of the spot price of a barrel of oil during February is collected. Data, U.S. dollars per barrel, are as follows: U.K Mexico U.A.E Oman 97.8 98.01 98.10 98.05 98.00 97.75 97.92 98.01 97.98 98.00 98.01 97.94 98.20 97.77 97.88 98.23 98.00 98.01 98.30 98.20 97.99 98.01 98.22 98.00 98.10 98.12 98.56 97.84 97.90 98.20 98.10 98.11 a). At 5% level of significance, what should the analyst conclude about whether or not the market for crude oil is efficient? Show all necessary work. b). What type of error is possible and describe this error in terms of the problem. c). At 5% level of significance, explain very carefully which sources differ in terms of the actual average price of a barrel oil. d). Explain the significance of the analysis you used to answer the question in part "c" and how this analysis works. Explain all aspects of the analysis very carefully. e). Using Minitab, generate the printouts of the plots for the statistical analysis you used in part (a). What information does each plot provide in terms of the above study? Explain Carefully

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts