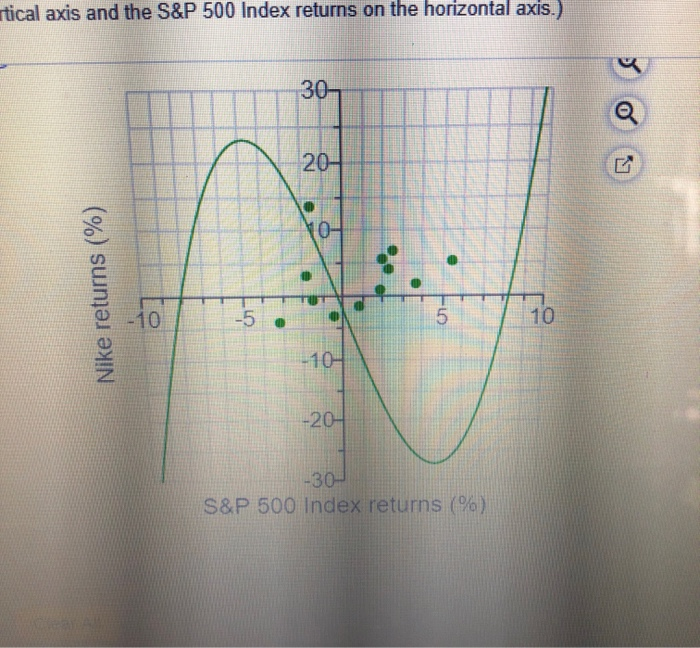

Question: Only answer part C & D pictures show answer choice A-D Money c. Develop a graph that shows the relationship between the Nike stock returns

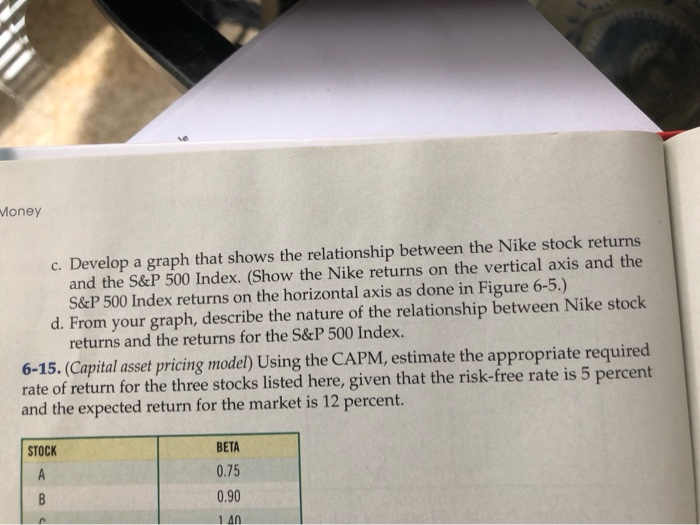

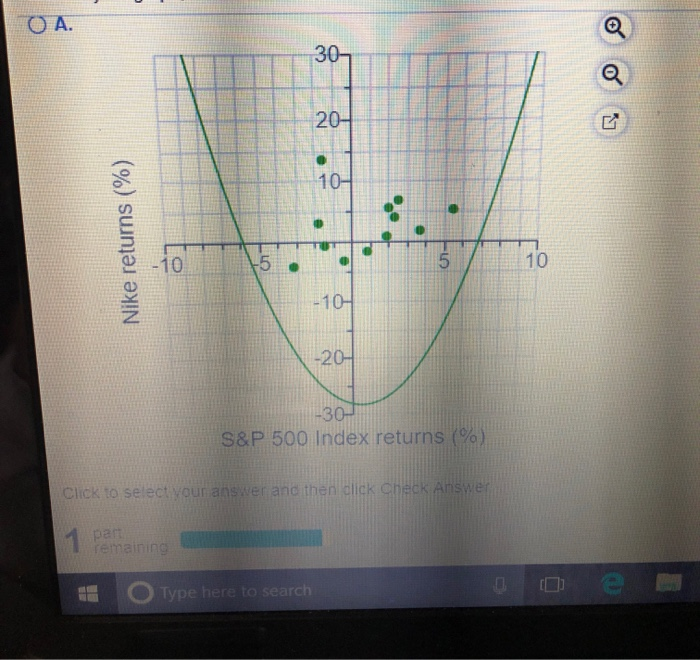

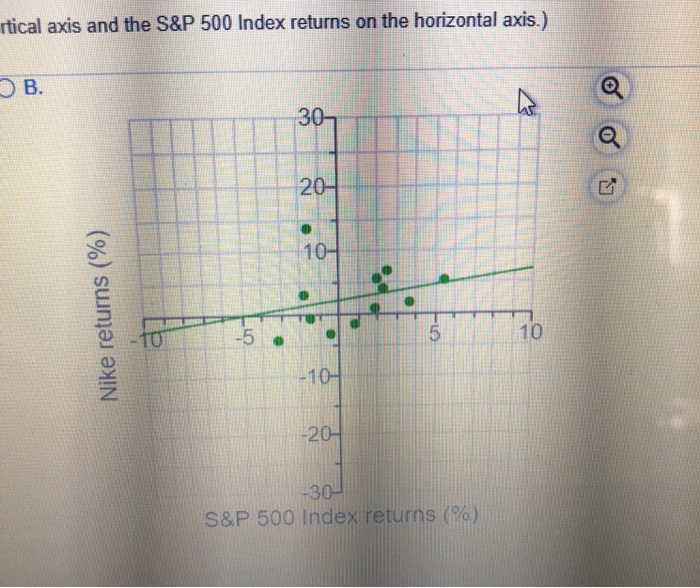

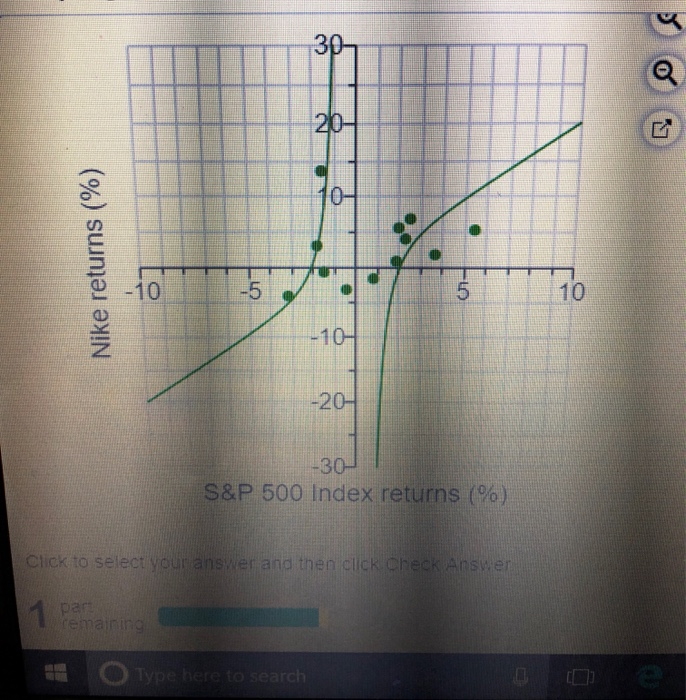

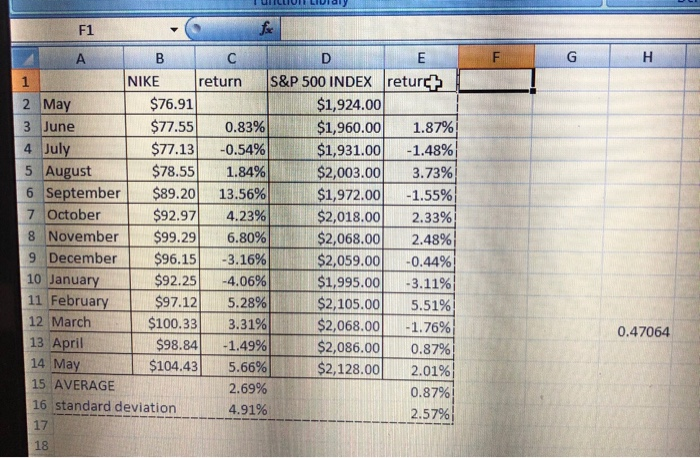

Money c. Develop a graph that shows the relationship between the Nike stock returns and the S&P 500 Index. (Show the Nike returns on the vertical axis and the S&P 500 Index returns on the horizontal axis as done in Figure 6-5.) d. From your graph, describe the nature of the relationship between Nike stock returns and the returns for the S&P 500 Index. 6-15. (Capital asset pricing model) Using the CAPM, estimate the appropriate required rate of return for the three stocks listed here, given that the risk-free rate is 5 percent and the expected return for the market is 12 percent. STOCK BETA 0.75 0.90 140 O A. Nike returns (%) |-10 -20 -30- S&P 500 Index returns (%) Click to select your answer and then dick Che Answer remaining 1 0 Type here to search rtical axis and the S&P 500 Index returns on the horizontal axis.) B. Nike returns (%) to 5 -20- -30 S&P 500 Index returns (%) 305 10- Nike returns (%) 20- -301 S&P 500 Index returns (%) Click to select your answer and then click check Answer par remaining Type here to search ftical axis and the S&P 500 Index returns on the horizontal axis.) 30 Nike returns (%) -20- -30 S&P 500 Index returns (%) 1 F1 - for A B C D E NIKE return S&P 500 INDEX returch 2 May $76.91 $1,924.00 3 June $77.55 0.83% $1,960.00 1.87% 4 July $77.13 -0.54% $1,931.00 -1.48% 5 August $78.55 1.84% $2,003.00 3.73% 6 September $89.20 13.56% $1,972.00 -1.55% 7 October $92.97 4.23% $2,018.00 2.33% 8 November $99.29 6.80% $2,068.00 2.48% 9 December $96.15 -3.16% $2,059.00 -0.44% 10 January $92.25 -4.06% $1,995.00 -3.11% 11 February $97.12 5.28% $2,105.00 5.51% 12 March $100.33 3.31% $2,068.00 -1.76% 13 April 2 $98.84 -1.49% $2,086.00 0.87% 14 May $104.43 5.66% $2,128.00 2.01% 15 AVERAGE 2.69% 0.87% 16 standard deviation 4.91% 2.57% 0.47064 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts