Question: **ONLY NEED HELP WITH PART B** The following is part of the computer output from a regression of monthly returns on Waterworks stock against the

**ONLY NEED HELP WITH PART B**

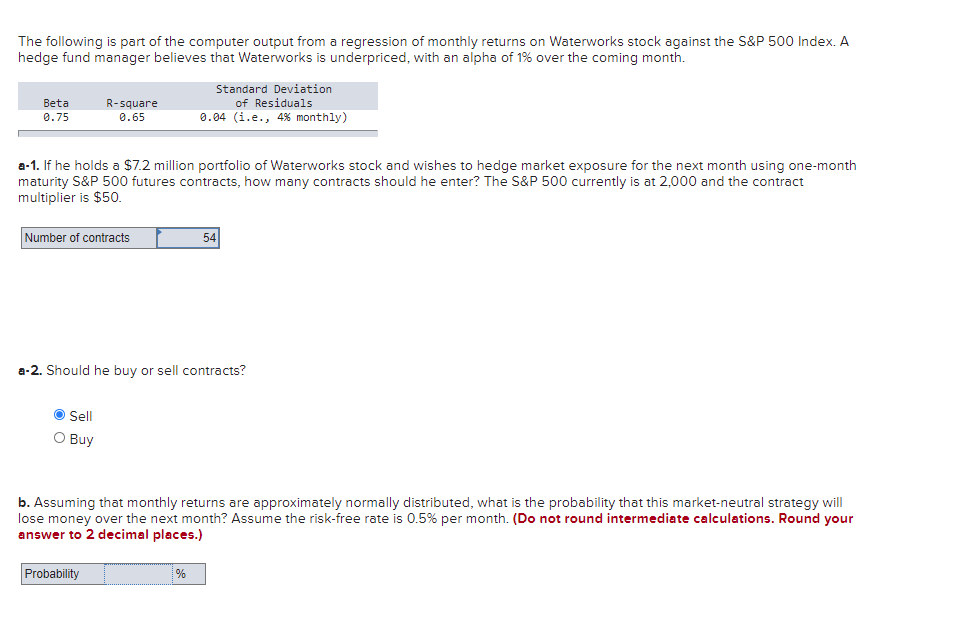

The following is part of the computer output from a regression of monthly returns on Waterworks stock against the S&P 500 Index. A hedge fund manager believes that Waterworks is underpriced, with an alpha of 1% over the coming month. Beta 0.75 R-square 0.65 Standard deviation of Residuals 0.94 (i.e., 4% monthly) a-1. If he holds a $7.2 million portfolio of Waterworks stock and wishes to hedge market exposure for the next month using one-month maturity S&P 500 futures contracts, how many contracts should he enter? The S&P 500 currently is at 2,000 and the contract multiplier is $50. Number of contracts 54 a-2. Should he buy or sell contracts? Sell O Buy b. Assuming that monthly returns are approximately normally distributed, what is the probability that this market-neutral strategy will lose money over the next month? Assume the risk-free rate is 0.5% per month. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Probability %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts