Question: Only part b to e is fine 1. Consider the following bond that pays coupon interest semi-annually. Coupon Yield to maturity Maturity (Years) Par Value

Only part b to e is fine

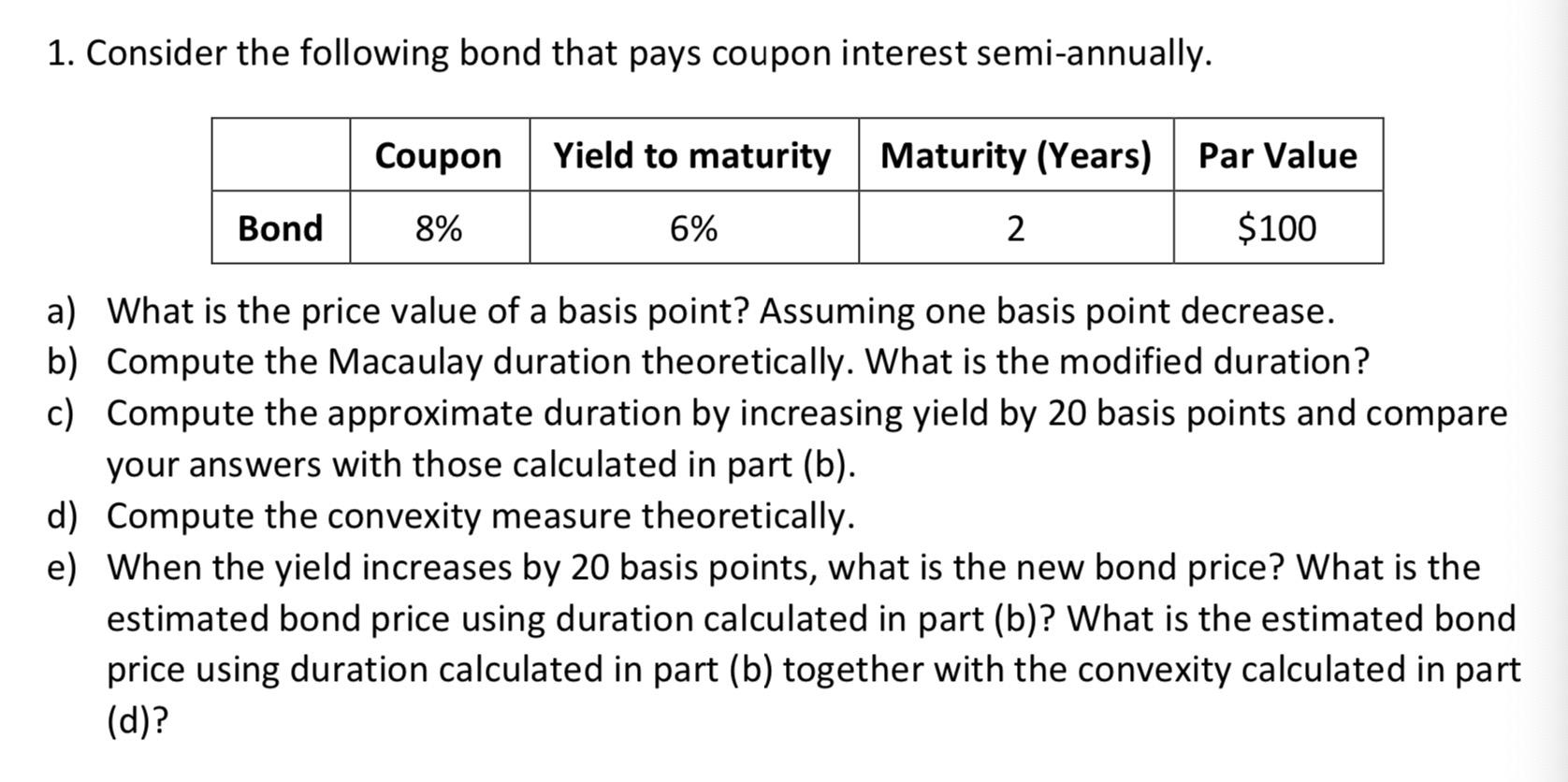

1. Consider the following bond that pays coupon interest semi-annually. Coupon Yield to maturity Maturity (Years) Par Value Bond 8% 6% 2 $100 a) What is the price value of a basis point? Assuming one basis point decrease. b) Compute the Macaulay duration theoretically. What is the modified duration? c) Compute the approximate duration by increasing yield by 20 basis points and compare your answers with those calculated in part (b). d) Compute the convexity measure theoretically. e) When the yield increases by 20 basis points, what is the new bond price? What is the estimated bond price using duration calculated in part (b)? What is the estimated bond price using duration calculated in part (b) together with the convexity calculated in part (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts