Question: ONLY point 3 a, b, c, d Ava Beane, the newly hired Manager of Inventory Planning, would like your assistance in evaluating several alternative courses

ONLY point 3 a, b, c, d

Ava Beane, the newly hired Manager of Inventory Planning, would like your assistance in evaluating several alternative courses of actions to address the inventory challenges faced by Scientific Glass. Please answer the following questions to help her analyze her options. The data for this analysis is provided in the exhibits in the case and also in the worksheet supplement for the Scientific Glass case in the HBS course-pack.

1. Given the finance department's forecast of a 20% increase in sales, how much more will SG have to invest in inventory to deal with the increase if nothing changes in its inventory management policies? Assume COGS (Cost of goods sold) increases by 20% and Months of inventory remain constant. (Hint: refer to the solved inventory problems document for additional examples) Using information in Exhibit 1, fill in the table below and calculate the increase in the value of the average inventory to meet the sales forecast.

2009 2010

Net Sales 86.3 103.56

COGS 38.9 46.68

Months of Inventory 2.69 2.69

Value of the Average Inventory ($) 6.8 9.582

Increase in inventory 1.7440

2. (Irrespective of your answer in question 1) Suppose the total value of 2010 inventory is $10 million and the increase in value of inventory required by Scientific Glass is $1.5 million.

Gregory and Hayes suggest four policy changes to reduce the value of the average inventory. For each suggested change below, estimate the savings that can be expected if the change is successfully implemented and discuss if the estimated savings can compensate for the increase of $1.5 million. a. It is estimated that for 10% of all products, Scientific Glass maintains too high of a service level. Assuming this high service level is 99.9% suppose the company enforces a strict 99% service level. Using data from the case and Exhibit 3, complete the table below. (Hint: Refer to the solved inventory problems document for additional examples)

| product | griffin beaker | erlenmeyer flask | ||

| service level | 99% | 99,9% | 99% | 99,9% |

| Z-Value | 2.33 | 3.09 | 2.33 | 3.09 |

| Average Weekly Demand | 27.1 | 27.1 | 8.1 | 8.1 |

| Stdev of Weekly Demand | 15.1 | 15.1 | 7.7 | 7.7 |

| POU (weeks) | 3 | 3 | 3 | 3 |

| Q | 142.4 | 162.3 | 55.6 | 65.8 |

| Average Pipeline Inventory | 27.1 | 27.1 | 8.1 | 8.1 |

| Begin on hand | 115.3 | 135.2 | 47.5 | 57.6 |

| SS | 61.1 | 81.1 | 31.2 | 41.3 |

| Average On-Hand | 88.2 | 108.1 | 39.3 | 49.5 |

| Average Inventory | 115.3 | 135.2 | 47.5 | 57.6 |

3. Assuming a service level of 99% for all parts, what will be the impact on the total inventory investment if the number of warehouses is reduced from 8 warehouses to 2? Reduced to 1? Assume that each of the 8 warehouse has roughly equal demand and, when consolidating the warehouses, the total demand across all 8 warehouses is equally divided between the remaining warehouses.

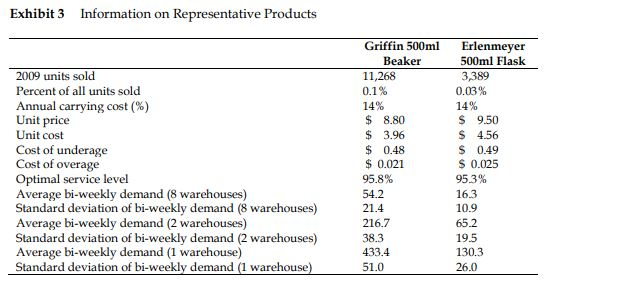

a. Using data from the case and Exhibit 3, complete the table below. Note that Exhibit 3 gives the standard deviation of the bi-weekly demand for 8, 2, and 1 warehouses respectively. Use these values to calculate the Stdev of weekly demand. (Hint: refer to the solved inventory problems document for additional examples)

| Product | Griffin Beaker | Erlenmeyer Flask | |||||

| Calculations for 1 warehouse | # of Warehouses | 8 | 2 | 1 | 8 | 2 | 1 |

| Z-Value | 2.33 | 2.33 | 2.33 | 2.33 | 2.33 | 2.33 | |

| Average Weekly Demand | |||||||

| Stdev of Weekly Demand | |||||||

| POU (weeks) | |||||||

| Q | |||||||

| Average Pipeline Inventory | |||||||

| Begin on hand | |||||||

| SS | |||||||

| Average On Hand | |||||||

| Average Inventory | |||||||

| Total Average Inventory (all warehouses) | |||||||

b. Calculate the percentage savings in total average Inventory investment from warehouse consolidation for each product. Assume lead time stays constant at 1 week:

i. from 8 warehouses to 2 warehouses.

ii. from 8 warehouses to 1 warehouse.

c. Take a simple average of the percent savings for each part and apply the resulting average percent savings to the entire North American finished goods (NA FG) inventory. Assume 2010 NA FG is $5 million. Calculate the total savings for the NA FG if:

i. 8 warehouses are consolidated to 2 warehouses.

ii. 8 warehouses are consolidated to 1 warehouse.

d. Would savings from consolidation compensate for the expected increase in inventory of $1.5 million if:

i. 8 warehouses are consolidated to 2 warehouses?

ii. 8 warehouses are consolidated to 1 warehouse?

Exhibit 3

Exhibit 3 Information on Representative Products 2009 units sold Percent of all units sold Annual carrying cost (%) Unit price Unit cost Cost of underage Cost of overage Optimal service level Average bi-weekly demand (8 warehouses) Standard deviation of bi-weekly demand (8 warehouses) Average bi-weekly demand (2 warehouses) Standard deviation of bi-weekly demand (2 warehouses) Average bi-weekly demand (1 warehouse) Standard deviation of bi-weekly demand (1 warehouse) Griffin 500ml Beaker 11,268 0.1% 14% $ 8.80 $ 3.96 $ 0.48 $ 0.021 95.8% 54.2 21.4 216.7 38.3 433.4 51.0 Erlenmeyer 500ml Flask 3,389 0.03% 14% $ 9.50 $ 4.56 $ 0.49 $ 0.025 95.3% 16.3 10.9 65.2 19.5 130.3 26.0 Exhibit 3 Information on Representative Products 2009 units sold Percent of all units sold Annual carrying cost (%) Unit price Unit cost Cost of underage Cost of overage Optimal service level Average bi-weekly demand (8 warehouses) Standard deviation of bi-weekly demand (8 warehouses) Average bi-weekly demand (2 warehouses) Standard deviation of bi-weekly demand (2 warehouses) Average bi-weekly demand (1 warehouse) Standard deviation of bi-weekly demand (1 warehouse) Griffin 500ml Beaker 11,268 0.1% 14% $ 8.80 $ 3.96 $ 0.48 $ 0.021 95.8% 54.2 21.4 216.7 38.3 433.4 51.0 Erlenmeyer 500ml Flask 3,389 0.03% 14% $ 9.50 $ 4.56 $ 0.49 $ 0.025 95.3% 16.3 10.9 65.2 19.5 130.3 26.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts