Question: Operating eash Inflows A fim is considering renewing ts equipment to meot increaswd demand for its product The cont of equipmect moefrications is $1.88milich plus

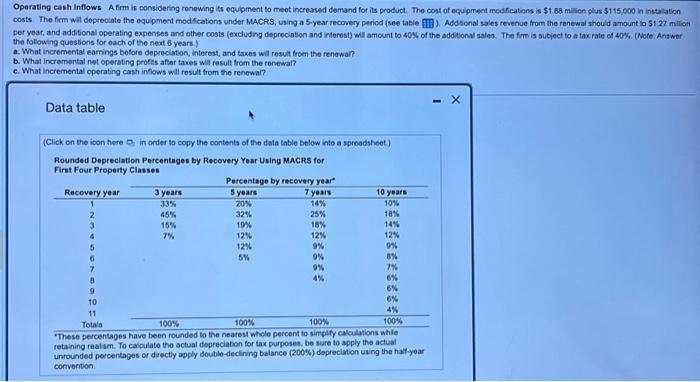

Operating eash Inflows A fim is considering renewing ts equipment to meot increaswd demand for its product The cont of equipmect moefrications is $1.88milich plus 5115,000 in instalation costs. The firm wat dopreciate the equipment modKications under MACRS, using a 5-year recovery period (see table I. Addsonal sales revenue from the renewal should amount io $1.27 millon per year, and additional operating expenses and other costs (excluding depreciation and interest) wil amount to 40B, of the additional sales. The fime is subject to a tax rate of 40%. (Wote. Answer the following questions for each of the next 6 years.) a. What incremental earrings belore depreciation, interest, and trxes wal result from the fonewai? b. What incremental not operating profis after tawes wil result from the ronewal? c. What incremental operating cash inflows will rosult from the renewal? Data table (Click on the icon here D. in order to copy the contents of the data table below into a spreadsheet) Rounded Depreclation Percentages by Recovery Year Using MAcrs for First Four Property classes "These percentages have been rounded to the neares whete percent to simpry cacumnons wnie retaining raalam. To calculato the actual depreciabon for tax purposes, bo sure to apply the actual unrounded peroentages or directly apply double-declining balance (200%) depreciation using the halyear convention the folowing questona for each of the next 6 years.) 2. What incromental eaming belore deprociation, Interest, and taxes wis resut trom the renewa? b. What incremental not operating profes aflor taies will result from the renewal? c. What incremental operating cash ihloms will result from the renewal? 2. The incremental protit before depreciason and tar ages (flound to the nearest dolar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts