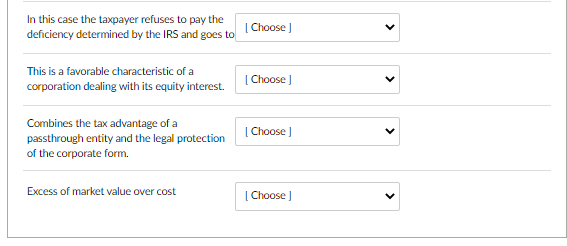

Question: Options are: AMT Subchapter K Cafeteria Plan Free Transferability LLC Small Tax Case Division C Corporation Consolidated Tax Return Stock Option Bargain Element Expatriates US

Options are:

AMT

Subchapter K

Cafeteria Plan

Free Transferability

LLC

Small Tax Case Division

C Corporation

Consolidated Tax Return

Stock Option

Bargain Element

Expatriates

US District Court or US Court of Federal Claims

US Tax Court

LLP

Constructive Dividend

In this case the taxpayer refuses to pay the deficiency determined by the IRS and goes to Choose] This is a favorable characteristic of a corporation dealing with its equity interest. Choose Combines the tax advantage of a passthrough entity and the legal protection of the corporate form. Choose] Excess of market value over cost [Choose]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts