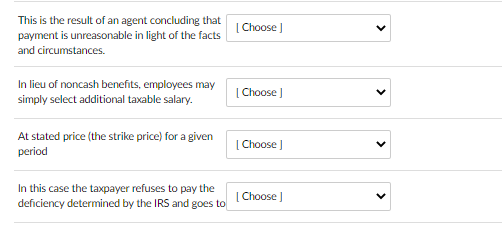

Question: Options are: AMT Subchapter K Cafeteria Plan Free Transferability LLC Small Tax Case Division C Corporation Consolidated Tax Return Stock Option Bargain Element Expatriates US

Options are:

AMT

Subchapter K

Cafeteria Plan

Free Transferability

LLC

Small Tax Case Division

C Corporation

Consolidated Tax Return

Stock Option

Bargain Element

Expatriates

US District Court or US Court of Federal Claims

US Tax Court

LLP

Constructive Dividend

| Choose This is the result of an agent concluding that payment is unreasonable in light of the facts and circumstances. In lieu of noncash benefits, employees may simply select additional taxable salary. [Choose] At stated price (the strike price) for a given period | Choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts