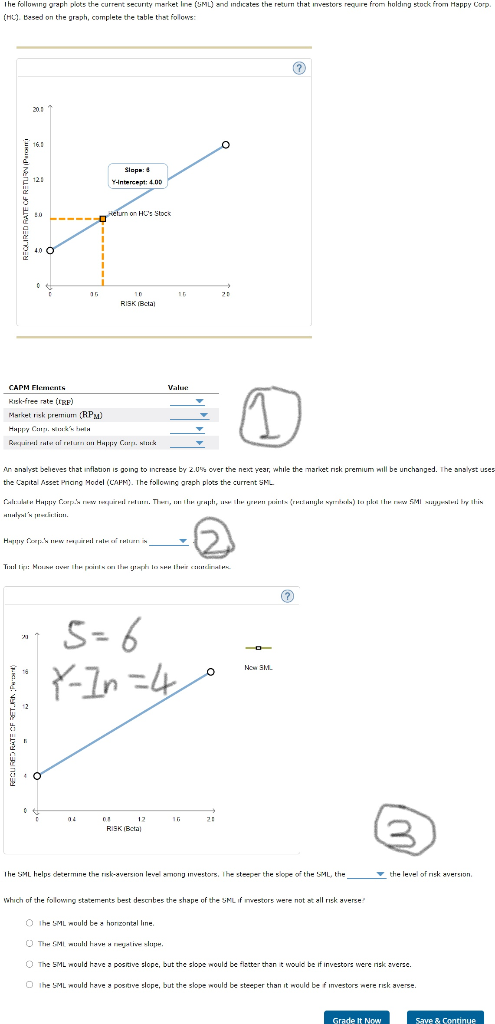

Question: Options for : (%) Risk-free rate (rRF): 4.4 4.0 2.2 7.6 Market risk premium (RPM): 7.8 4.5 6.0 10.8 Happy Corp. stocks beta: 0.6 1.4

Options for : (%)

Risk-free rate (rRF): 4.4 4.0 2.2 7.6

Market risk premium (RPM): 7.8 4.5 6.0 10.8

Happy Corp. stocks beta: 0.6 1.4 0.2 1.0

Required rate of return on Happy Corp. stock 6.5 7.6 9.5 6.8

Options for : (%) 9.6 22.1 6.7 10.6

Options for : lower, higher

The following graph plots the current security market Ine (SML) and indicates the return that investors require from holding stock from Happy Corp (HU). Besed on the graph, complete the table that follows: 161 F 12: Sloped Yuntercept: 4.00 30 Helum on HC Stock 400 1 2 20 10 RISK Beta Value CAPM Elements Risk-free rate (ERP) Marketisk premium (RPM) Happy Cook Rilm a Happy Cat II An analyst believes that inflation is going to increase by 2.05 over the next year, while the market risk premium will be unchanged. The analyst uses the Capital Asset Pnang Model (CAFM. The following graph plots the current SML Cable y Cep w respirar. Tari, eh, en pazila (my) lapkri hrww SMI tryihin Hi. Hy repair Toli: Hotel Capo Cock 5=6 Y-In=4 Now SM 6 O O 04 2: 0 12 RISK Betal The SML helps determine the risk-aversion level among investors. The steeper the slope of the SML, the the level of risk aversion Which of the folowing statements best decorates the shape of the SML if westors were not at all risk averse The SML rould be a horizontal line The MulhAVrieslap The SML would have a positive slope, but the slope would be letter than it would be if investors were nisk overse. The SML mould have a positive slope, but the slope would be steeper than it would be finvestors were risk averse Grade It Now Save & Continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts