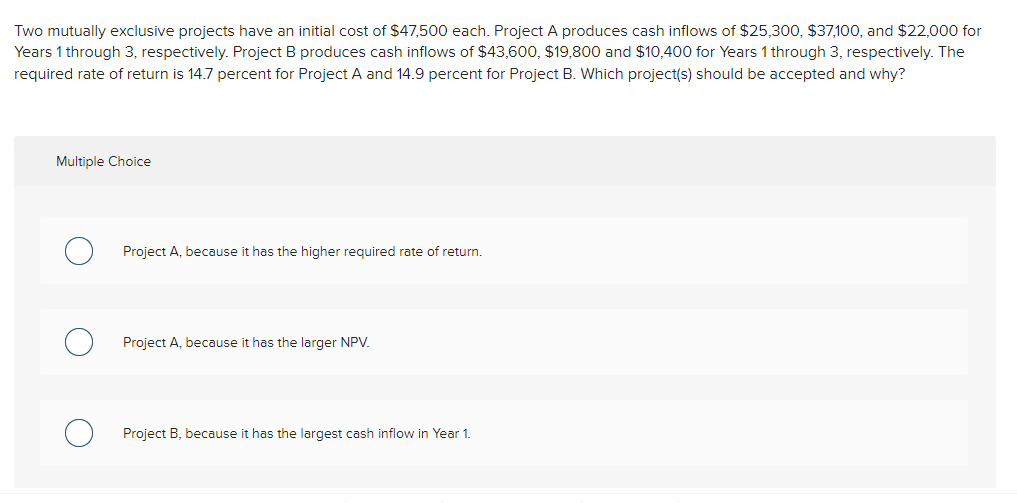

Question: Other answer choices: d) Project B, because it has the higher required rate of return e) Project B, because it has the larger NPV Two

Other answer choices:

d) Project B, because it has the higher required rate of return

e) Project B, because it has the larger NPV

Two mutually exclusive projects have an initial cost of $47,500 each. Project A produces cash inflows of $25,300,$37,100, and $22,000 for Years 1 through 3, respectively. Project B produces cash inflows of $43,600,$19,800 and $10,400 for Years 1 through 3, respectively. The required rate of return is 14.7 percent for Project A and 14.9 percent for Project B. Which project(s) should be accepted and why? Multiple Choice Project A, because it has the higher required rate of return. Project A, because it has the larger NPV. Project B, because it has the largest cash inflow in Year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts