Other information: Intercompany sales: On January 1, Year 10: Salt had on hand $30,000 of inventory purchased

Question:

Other information:

- Intercompany sales: On January 1, Year 10:

Salt had on hand $30,000 of inventory purchased from Pillar. Pillar had on hand $90,000 of inventory purchased from Salt.

Both companies use a gross profit of 40% of sales.

During Year 10, Pillar sold $90,000 of goods to Salt.

On December 31, Year 10, 40% of the goods were unsold.

During 2010 Salt sold $720,000 of goods to Pillar. On Dec. 31, Year 10, 20% were unsold. Both companies have a gross profit on sales of 40%. There were no other intercompany sales.

2. During Year 6, Pillar sold land to Salt at a profit of $60,000. Salt still owns the land.

Required:

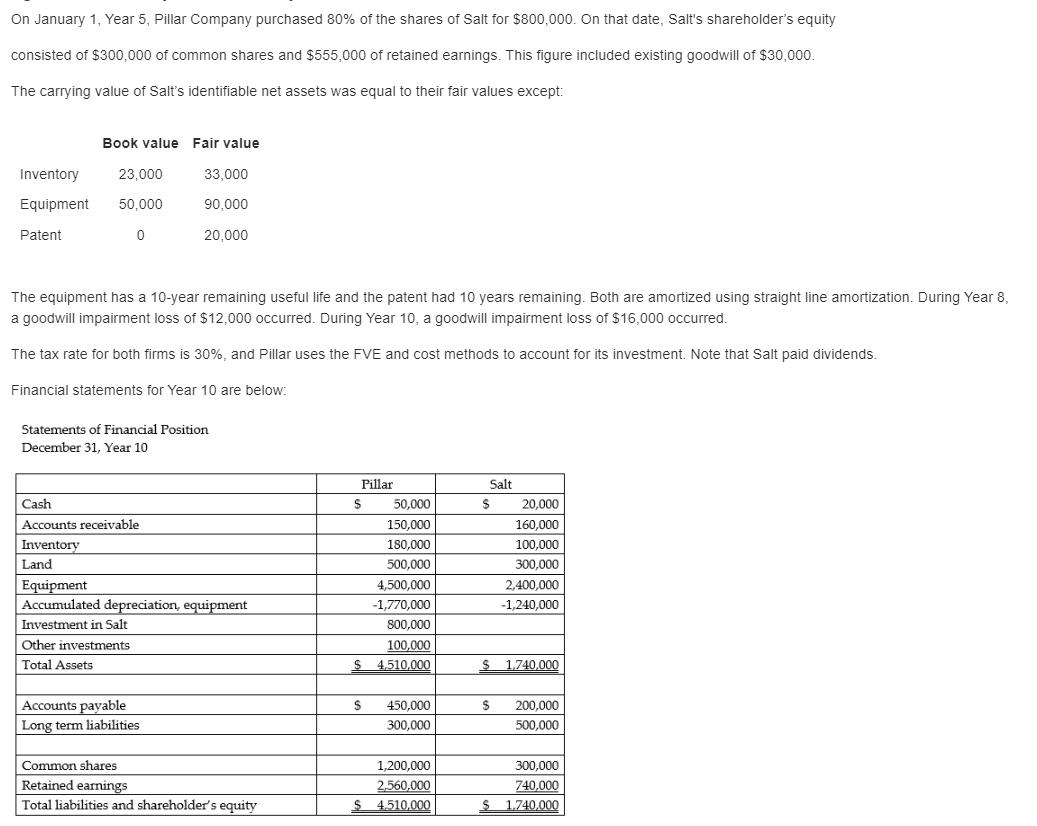

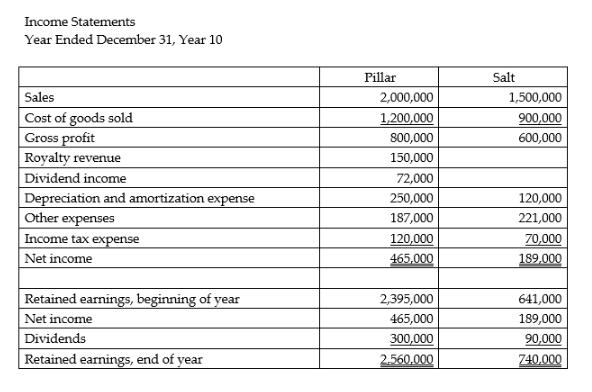

A. Prepare all the calculations required to prepare consolidated financial statements.

- Calculate the acquisition differential, goodwill, and NCI, and prepare the ADA table

- Calculate unrealized inventory profits before and after tax

- Calculate consolidated net income and the NCI share.

- Calculate consolidated retained earnings and NCI Balance Sheet.

Calculations above are required .

B. Prepare a consolidated income statement for Year 10 that includes a section below net income attributing income to shareholders of Pillar and NCI shareholders. Prepare a consolidated balance sheet for Year 10. Prepare statements in good form.

Modern Advanced Accounting In Canada

ISBN: 9781259066481

7th Edition

Authors: Hilton Murray, Herauf Darrell