Question: Our client, Chupa Chip Microchips is a leading niche microchip manufacturer that owns around 30% of the global market. Chupa Chip's main competitor, Megaship Microchips,

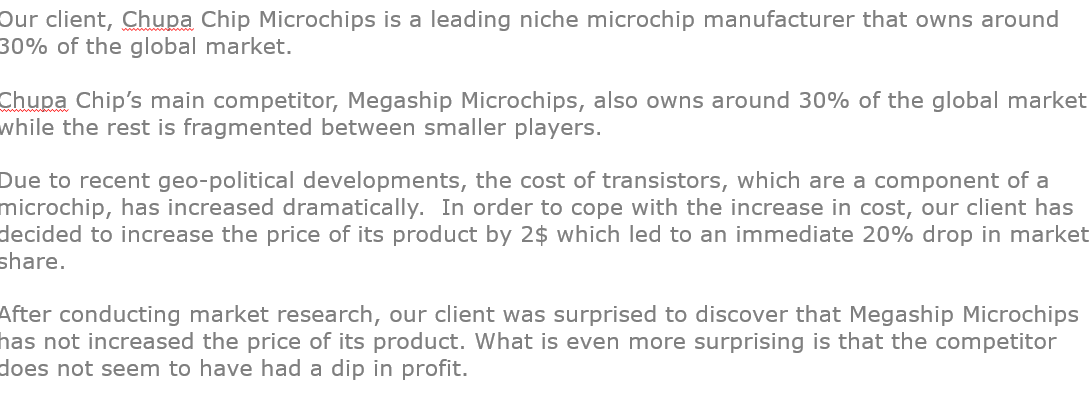

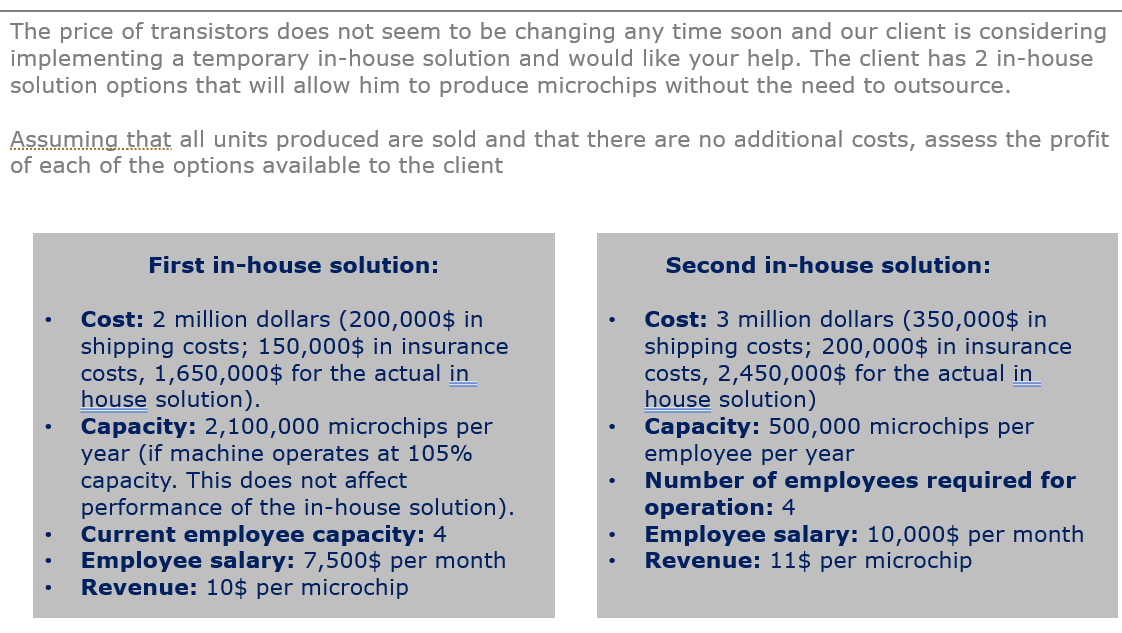

Our client, Chupa Chip Microchips is a leading niche microchip manufacturer that owns around 30% of the global market. Chupa Chip's main competitor, Megaship Microchips, also owns around 30% of the global market while the rest is fragmented between smaller players. Due to recent geo-political developments, the cost of transistors, which are a component of a microchip, has increased dramatically. In order to cope with the increase in cost, our client has decided to increase the price of its product by 2$ which led to an immediate 20% drop in market share. After conducting market research, our client was surprised to discover that Megaship Microchips has not increased the price of its product. What is even more surprising is that the competitor does not seem to have had a dip in profit. The price of transistors does not seem to be changing any time soon and our client is considering implementing a temporary in-house solution and would like your help. The client has 2 in-house solution options that will allow him to produce microchips without the need outsource. Assuming that all units produced are sold and that there are no additional costs, assess the profit of each of the options available to the client First in-house solution: Cost: 2 million dollars (200,000$ in shipping costs; 150,000$ in insurance costs, 1,650,000$ for the actual in house solution). Capacity: 2,100,000 microchips per year (if machine operates at 105% capacity. This does not affect performance of the in-house solution). Current employee capacity: 4 Employee salary: 7,500$ per month Revenue: 10$ per microchip Second in-house solution: Cost: 3 million dollars (350,000$ in shipping costs; 200,000$ in insurance costs, 2,450,000$ for the actual in house solution) Capacity: 500,000 microchips per employee per year Number of employees required for operation: 4 Employee salary: 10,000$ per month Revenue: 11$ per microchip Our client, Chupa Chip Microchips is a leading niche microchip manufacturer that owns around 30% of the global market. Chupa Chip's main competitor, Megaship Microchips, also owns around 30% of the global market while the rest is fragmented between smaller players. Due to recent geo-political developments, the cost of transistors, which are a component of a microchip, has increased dramatically. In order to cope with the increase in cost, our client has decided to increase the price of its product by 2$ which led to an immediate 20% drop in market share. After conducting market research, our client was surprised to discover that Megaship Microchips has not increased the price of its product. What is even more surprising is that the competitor does not seem to have had a dip in profit. The price of transistors does not seem to be changing any time soon and our client is considering implementing a temporary in-house solution and would like your help. The client has 2 in-house solution options that will allow him to produce microchips without the need outsource. Assuming that all units produced are sold and that there are no additional costs, assess the profit of each of the options available to the client First in-house solution: Cost: 2 million dollars (200,000$ in shipping costs; 150,000$ in insurance costs, 1,650,000$ for the actual in house solution). Capacity: 2,100,000 microchips per year (if machine operates at 105% capacity. This does not affect performance of the in-house solution). Current employee capacity: 4 Employee salary: 7,500$ per month Revenue: 10$ per microchip Second in-house solution: Cost: 3 million dollars (350,000$ in shipping costs; 200,000$ in insurance costs, 2,450,000$ for the actual in house solution) Capacity: 500,000 microchips per employee per year Number of employees required for operation: 4 Employee salary: 10,000$ per month Revenue: 11$ per microchip

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts