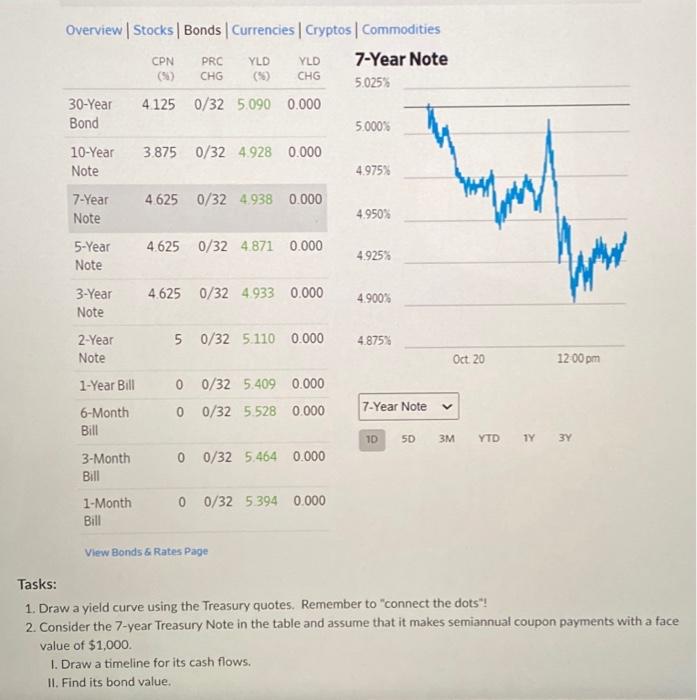

Question: Overview | Stocks | Bonds | Currencies | Cryptos | Commodities 7-Year Note 5.025% 10-Year Note 7-Year Note 5-Year Note 30-Year 4.125 0/32 5.090 0.000

7-Year Note 10 503M YTD IY 3Y View Bonds & Rates Page Tasks: 1. Draw a yield curve using the Treasury quotes. Remember to "connect the dots"? 2. Consider the 7-year Treasury Note in the table and assume that it makes semiannual coupon payments with a face value of $1,000. 1. Draw a timeline for its cash flows. II. Find its bond value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts