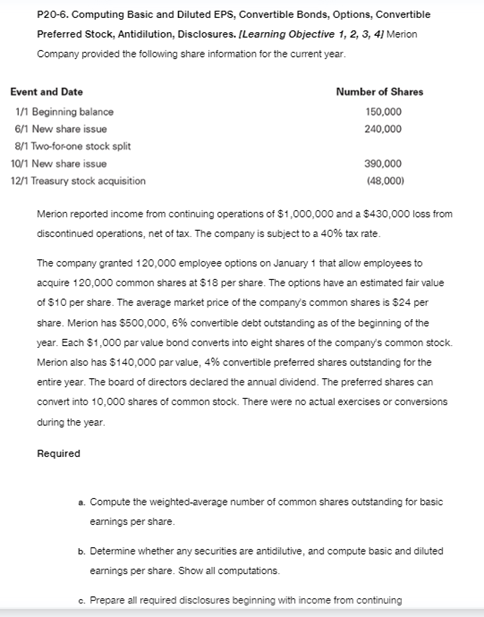

Question: P20-6. Computing Basic and Diluted EPS, Convertible Bonds, Options, Convertible Preferred Stock, Antidilution, Disclosures. ILearning Objective 1, 2, 3, 4/ Merion Company provided the following

P20-6. Computing Basic and Diluted EPS, Convertible Bonds, Options, Convertible Preferred Stock, Antidilution, Disclosures. ILearning Objective 1, 2, 3, 4/ Merion Company provided the following share information for the current year. Merion reported income from continuing operations of $1,000,000 and a $430,000 loss from discontinued operations, net of tax. The company is subject to a 40% tax rate. The company granted 120,000 employee options on January 1 that allow employees to acquire 120,000 common shares at $18 per share. The options have an estimated fair value of $10 per share. The average market price of the company's common shares is $24 per share. Merion has $500,000,6% convertible debt outstanding as of the beginning of the year. Each $1,000 par value bond converts into eight shares of the company's common stock. Merion also has $140,000 par value, 4% convertible preterred shares outstanding for the entire year. The board of directors declared the annual dividend. The preferred shares can convert into 10,000 shares of common stock. There were no actual exercises or conversions during the year. Required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts