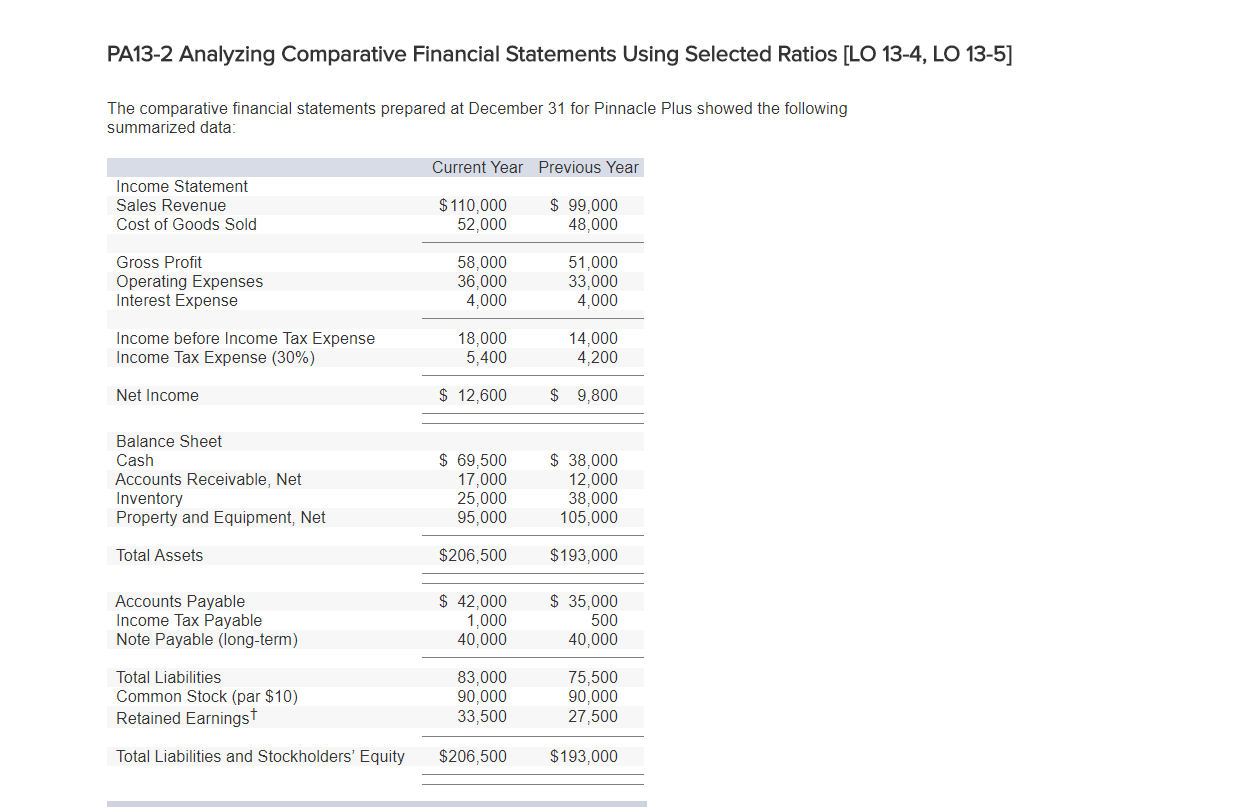

Question: PA13-2 Analyzing Comparative Financial Statements Using Selected Ratios [LO 13-4, LO 13-5] The comparative financial statements prepared at December 31 for Pinnacle Plus showed the

![13-5] The comparative financial statements prepared at December 31 for Pinnacle Plus](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fb84beec748_55066fb84bed6638.jpg)

PA13-2 Analyzing Comparative Financial Statements Using Selected Ratios [LO 13-4, LO 13-5] The comparative financial statements prepared at December 31 for Pinnacle Plus showed the following summarized data Current Year Previous Year Income Statement Sales Revenue Cost of Goods Sold $110,000 52,000 $ 99,000 48.000 Gross Profit Operating Expenses Interest Expense 58,000 36,000 4,000 51,000 33,000 4,000 Income before Income lax Expense Income Tax Expense (30%) 18,000 5,400 14,000 4.200 Net Income $ 12,600 $ 9,800 Balance Sheet Cash Accounts Receivable, Net Inventory Property and Equipment, Net $ 69,500 17.000 25,000 95,000 $ 38,000 12.000 38,000 105,000 Total Assets $206,500 $193,000 Accounts Payable Income lax Payable Note Payable (long-term) $ 42,000 1,000 40,000 $ 35,000 500 40.000 Total Liabilities Common Stock (par $10) Retained EarningsT 83,000 90,000 33,500 75,500 90,000 27,500 Total Liabilities and StockholdersEquity $206,500 $193,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts