Question: Palm makes handheld computers and was owned by 3Com, a company selling computer network systems and services. On March 2nd, 2000, 3Com sold a fraction

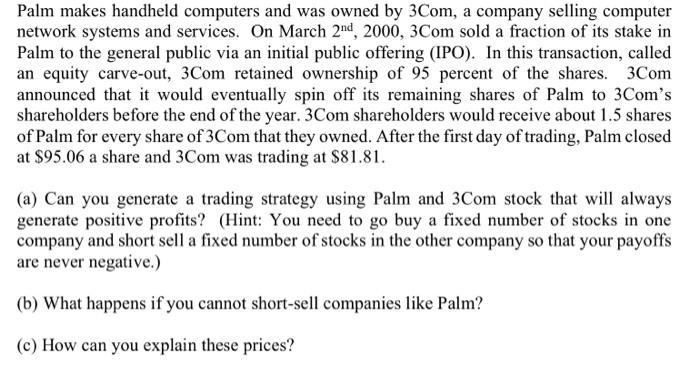

Palm makes handheld computers and was owned by 3Com, a company selling computer network systems and services. On March 2nd, 2000, 3Com sold a fraction of its stake in Palm to the general public via an initial public offering (IPO). In this transaction, called an equity carve-out, 3Com retained ownership of 95 percent of the shares. 3Com announced that it would eventually spin off its remaining shares of Palm to 3Com's shareholders before the end of the year. 3Com shareholders would receive about 1.5 shares of Palm for every share of 3Com that they owned. After the first day of trading, Palm closed at $95.06 a share and 3Com was trading at $81.81. (a) Can you generate a trading strategy using Palm and 3Com stock that will always generate positive profits? (Hint: You need to go buy a fixed number of stocks in one company and short sell a fixed number of stocks in the other company so that your payoffs are never negative.) (b) What happens if you cannot short-sell companies like Palm? (c) How can you explain these prices? Palm makes handheld computers and was owned by 3Com, a company selling computer network systems and services. On March 2nd, 2000, 3Com sold a fraction of its stake in Palm to the general public via an initial public offering (IPO). In this transaction, called an equity carve-out, 3Com retained ownership of 95 percent of the shares. 3Com announced that it would eventually spin off its remaining shares of Palm to 3Com's shareholders before the end of the year. 3Com shareholders would receive about 1.5 shares of Palm for every share of 3Com that they owned. After the first day of trading, Palm closed at $95.06 a share and 3Com was trading at $81.81. (a) Can you generate a trading strategy using Palm and 3Com stock that will always generate positive profits? (Hint: You need to go buy a fixed number of stocks in one company and short sell a fixed number of stocks in the other company so that your payoffs are never negative.) (b) What happens if you cannot short-sell companies like Palm? (c) How can you explain these prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts