Question: PART 1: It has been more than a year since the Kranworth Chair Company (KCC) formed two divisions Custom Division and Retail Division. The first

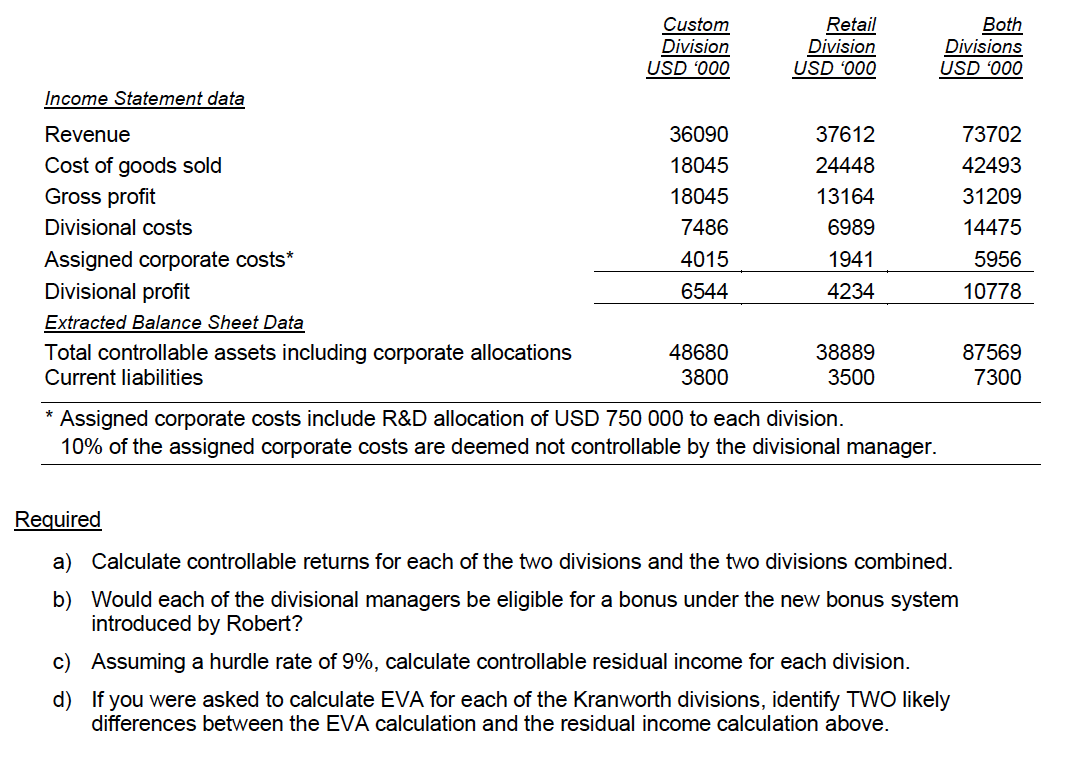

PART 1: It has been more than a year since the Kranworth Chair Company (KCC) formed two divisions Custom Division and Retail Division. The first set of financials is available following the introduction of the new bonus scheme with controllable returns (CR) as the central feature. Robert has decided that the CR targets for each division will be equal to the current years performance plus an additional percentage point. So for example, if current performance was 10%; the target for the subsequent year would be 11%. Robert has decided he needs continuous improvement! For the current year, he has set CR targets for the Custom Division and the Retail Division at 11% and 13% respectively.

Required

- a)Calculate controllable returns for each of the two divisions and the two divisions combined.

- b)Would each of the divisional managers be eligible for a bonus under the new bonus systemintroduced by Robert?

- c)Assuming a hurdle rate of 9%, calculate controllable residual income for each division.

- d)If you were asked to calculate EVA for each of the Kranworth divisions, identify TWO likelydifferences between the EVA calculation and the residual income calculation above.

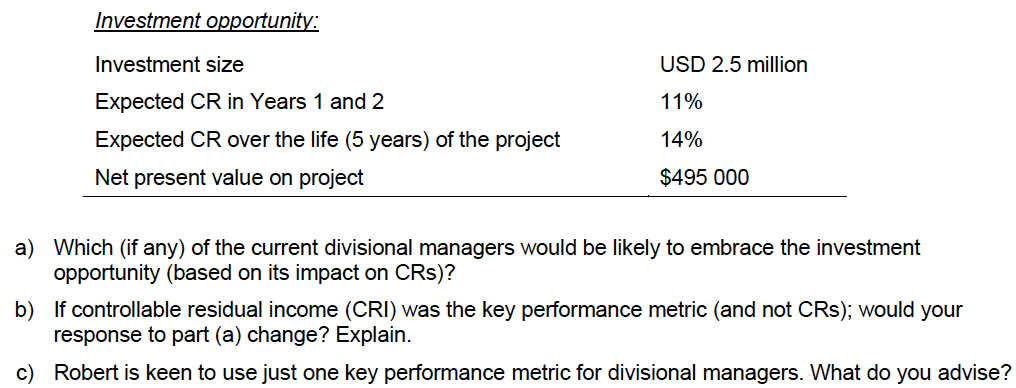

PART 2: The following investment opportunity has been developed and presented to each of the divisional managers Joseph and Ed. The investment is in line with strategy in that it will facilitate higher quality production and would be suitable in either division.

7486 Custom Retail Both Division Division Divisions USD '000 USD 4000 USD '000 Income Statement data Revenue 36090 37612 73702 Cost of goods sold 18045 24448 42493 Gross profit 18045 13164 31209 Divisional costs 6989 14475 Assigned corporate costs* 4015 1941 5956 Divisional profit 6544 4234 10778 Extracted Balance Sheet Data Total controllable assets including corporate allocations 48680 38889 87569 Current liabilities 3800 3500 7300 * Assigned corporate costs include R&D allocation of USD 750 000 to each division. 10% of the assigned corporate costs are deemed not controllable by the divisional manager. Required a) Calculate controllable returns for each of the two divisions and the two divisions combined. b) Would each of the divisional managers be eligible for a bonus under the new bonus system introduced by Robert? c) Assuming a hurdle rate of 9%, calculate controllable residual income for each division. d) If you were asked to calculate EVA for each of the Kranworth divisions, identify TWO likely differences between the EVA calculation and the residual income calculation above. Investment opportunity: Investment size Expected CR in Years 1 and 2 Expected CR over the life (5 years) of the project Net present value on project USD 2.5 million 11% 14% $495 000 a) Which (if any) of the current divisional managers would be likely to embrace the investment opportunity (based on its impact on CRs)? b) If controllable residual income (CRI) was the key performance metric (and not CRs); would your response to part (a) change? Explain. c) Robert is keen to use just one key performance metric for divisional managers. What do you advise? 7486 Custom Retail Both Division Division Divisions USD '000 USD 4000 USD '000 Income Statement data Revenue 36090 37612 73702 Cost of goods sold 18045 24448 42493 Gross profit 18045 13164 31209 Divisional costs 6989 14475 Assigned corporate costs* 4015 1941 5956 Divisional profit 6544 4234 10778 Extracted Balance Sheet Data Total controllable assets including corporate allocations 48680 38889 87569 Current liabilities 3800 3500 7300 * Assigned corporate costs include R&D allocation of USD 750 000 to each division. 10% of the assigned corporate costs are deemed not controllable by the divisional manager. Required a) Calculate controllable returns for each of the two divisions and the two divisions combined. b) Would each of the divisional managers be eligible for a bonus under the new bonus system introduced by Robert? c) Assuming a hurdle rate of 9%, calculate controllable residual income for each division. d) If you were asked to calculate EVA for each of the Kranworth divisions, identify TWO likely differences between the EVA calculation and the residual income calculation above. Investment opportunity: Investment size Expected CR in Years 1 and 2 Expected CR over the life (5 years) of the project Net present value on project USD 2.5 million 11% 14% $495 000 a) Which (if any) of the current divisional managers would be likely to embrace the investment opportunity (based on its impact on CRs)? b) If controllable residual income (CRI) was the key performance metric (and not CRs); would your response to part (a) change? Explain. c) Robert is keen to use just one key performance metric for divisional managers. What do you advise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts