Question: [Part 1. This same information is presented in the next question.) You work for personal transport firm. The CEO walks into your office and asks

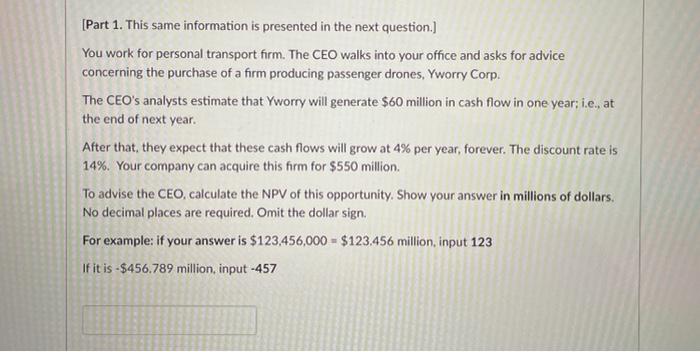

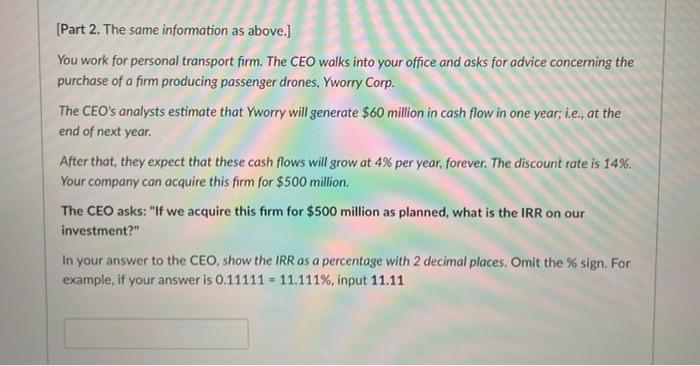

[Part 1. This same information is presented in the next question.) You work for personal transport firm. The CEO walks into your office and asks for advice concerning the purchase of a firm producing passenger drones, Yworry Corp. The CEO's analysts estimate that Yworry will generate $60 million in cash flow in one year; i.e, at the end of next year. After that, they expect that these cash flows will grow at 4% per year, forever. The discount rate is 14%. Your company can acquire this form for $550 million. To advise the CEO, calculate the NPV of this opportunity. Show your answer in millions of dollars. No decimal places are required. Omit the dollar sign For example: if your answer is $123,456,000 - $123.456 million, input 123 If it is -$456.789 million input-457 [Part 2. The same information as above.) You work for personal transport form. The CEO walks into your office and asks for advice concerning the purchase of a firm producing passenger drones, Yworry Corp. The CEO's analysts estimate that Yworry will generate $60 million in cash flow in one year, i.e., at the end of next year. After that, they expect that these cash flows will grow at 4% per year forever. The discount rate is 14%. Your company can acquire this form for $500 million. The CEO asks: "If we acquire this form for $500 million as planned, what is the IRR on our investment?" In your answer to the CEO, show the IRR as a percentage with 2 decimal places. Omit the % sign. For example, if your answer is 0.11111 = 11.111%, input 11.11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts