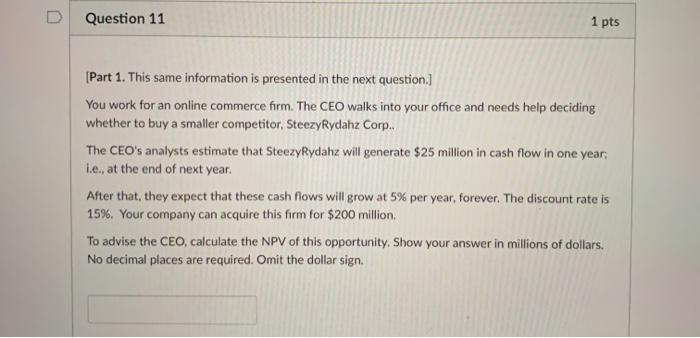

Question: Question 11 1 pts [Part 1. This same information is presented in the next question.] You work for an online commerce firm. The CEO walks

![in the next question.] You work for an online commerce firm. The](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ed829b85384_49966ed829b2a68a.jpg)

Question 11 1 pts [Part 1. This same information is presented in the next question.] You work for an online commerce firm. The CEO walks into your office and needs help deciding whether to buy a smaller competitor, SteezyRydahz Corp.. The CEO's analysts estimate that SteezyRydahu will generate $25 million in cash flow in one year, Le., at the end of next year. After that, they expect that these cash flows will grow at 5% per year, forever. The discount rate is 15%. Your company can acquire this form for $200 million. To advise the CEO, calculate the NPV of this opportunity. Show your answer in millions of dollars. No decimal places are required. Omit the dollar sign. [Part 2. The same information as above.) You work for an online commerce firm. The CEO walks into your office and needs help deciding whether to buy a smaller competitor, SteezyRydahz Corp.. The CEO's analysts estimate that SteezyRydahz will generate $25 million in cash flow in one year, ie, at the end of next year. After that, they expect that these cash flows will grow at 5% per year, forever. The discount rate is 15% Your company can acquire this form for $200 million The CEO asks: "If we acquire this form for $200 million as planned, what is the IRR on our investment?" In your answer to the CEO, show the IRR as a percentage with 2 decimal places. Omit the % sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts