Question: two different answers [Part 1. This same information is presented in the next question.) You work for an online commerce firm. The CEO walks into

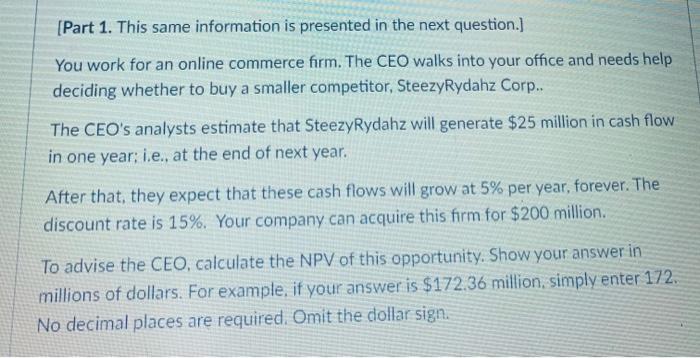

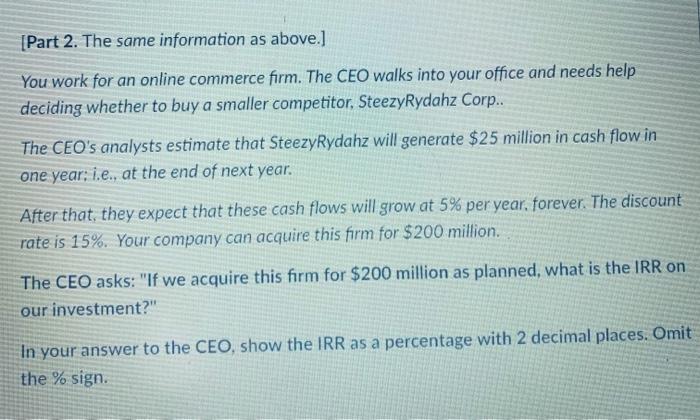

[Part 1. This same information is presented in the next question.) You work for an online commerce firm. The CEO walks into your office and needs help deciding whether to buy a smaller competitor, SteezyRydahz Corp.. The CEO's analysts estimate that SteezyRydahz will generate $25 million in cash flow in one year: i.e., at the end of next year. After that, they expect that these cash flows will grow at 5% per year, forever. The discount rate is 15%. Your company can acquire this firm for $200 million. To advise the CEO, calculate the NPV of this opportunity. Show your answer in millions of dollars. For example, if your answer is $172.36 million, simply enter 172. No decimal places are required. Omit the dollar sign. [Part 2. The same information as above.] You work for an online commerce firm. The CEO walks into your office and needs help deciding whether to buy a smaller competitor, SteezyRydahz Corp.. The CEO's analysts estimate that SteezyRydahz will generate $25 million in cash flow in one year; i.e., at the end of next year. After that, they expect that these cash flows will grow at 5% per year, forever. The discount rate is 15%. Your company can acquire this form for $200 million. The CEO asks: "If we acquire this form for $200 million as planned, what is the IRR on our investment?" In your answer to the CEO, show the IRR as a percentage with 2 decimal places. Omit the % sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts