Question: Part 2 (50 marks) Part two requires calculations to answer the questions. Furthermore, it requires qualitative explanations that convey your understanding of the concepts of

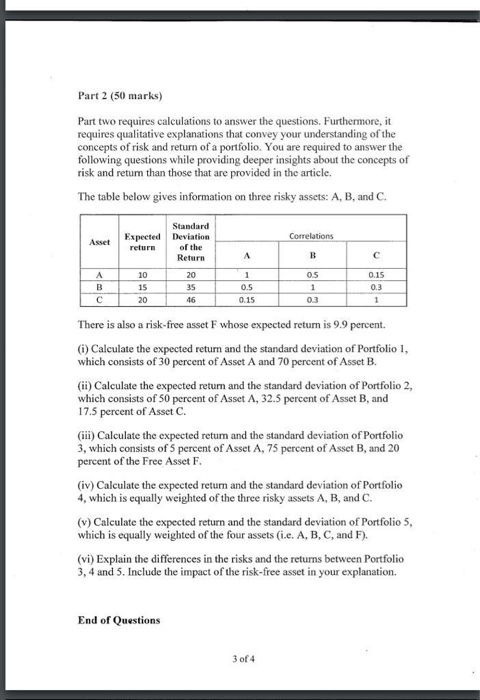

Part 2 (50 marks) Part two requires calculations to answer the questions. Furthermore, it requires qualitative explanations that convey your understanding of the concepts of risk and return of a portfolio. You are required to answer the following questions while providing deeper insights about the concepts of risk and return than those that are provided in the article The table below gives information on three risky assets: A, B, and C Asset Expected Deviation of the 10 15 20 20 35 0.5 0.15 0.3 0.5 0.15 There is also a risk-free asset F whose expected return is 9.9 percent. (i) Calculate the expected return and the standard deviation of Portfolio which consists of 30 percent of Asset A and 70 percent of Asset B. (ii) Calculate the expected return and the standard deviation of Portfolio 2, which consists of 50 percent of Asset A, 32.5 percent of Asset B, and 17.5 percent of Asset C (iii) Calculate the expected return and the standard deviation of Portfolio 3, which consists of 5 percent of Asset A, 75 percent of Asset B, and 20 percent of the Free Asset F (iv) Calculate the expected return and the standard deviation of Portfolio 4, which is equally weighted of the three risky assets A, B, and C (v) Calculate the expected return and the standard deviation of Portfolio 5, which is equally weighted of the four assets (i.e. A, B, C, and F) (vi) Explain the differences in the risks and the returns between Portfolio 3, 4 and 5. Include the impact of the risk-free asset in your explanation. End of Questions 3 of 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts