Question: Part 2 (50 marks) Part two requires calculations to answer the questions. Furthermore, it requires qualitative explanations that convey your understanding of the concepts of

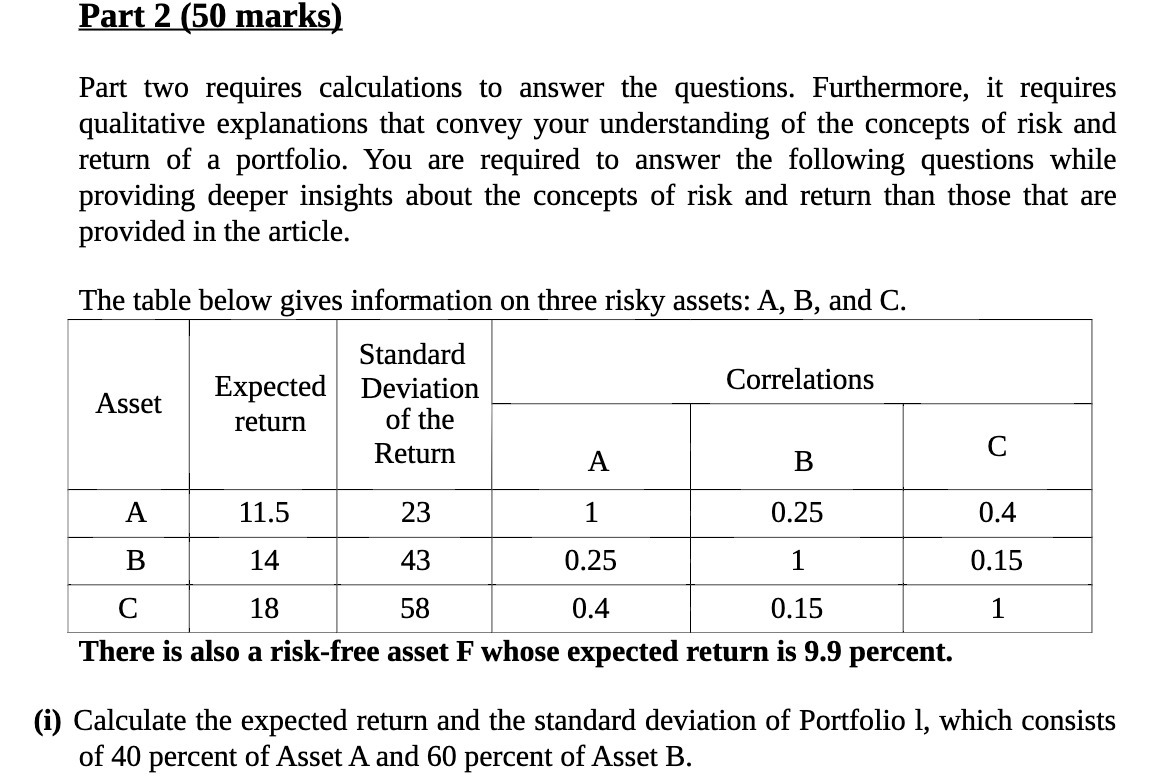

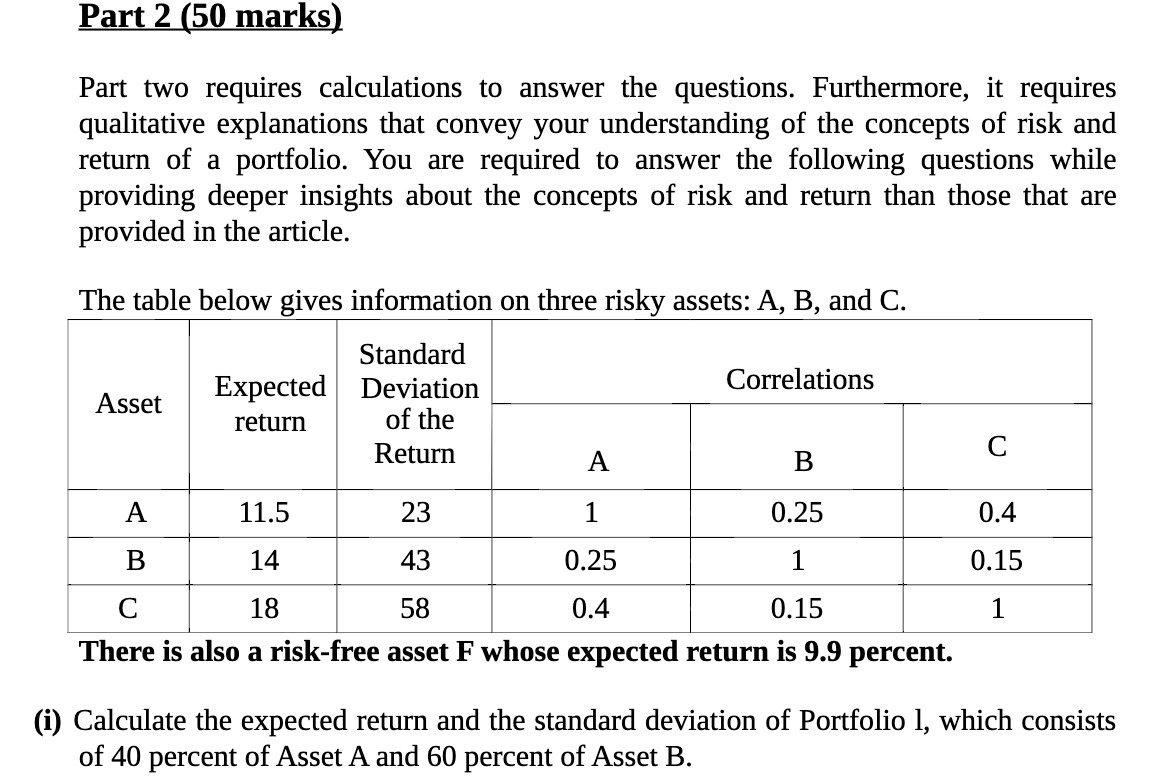

Part 2 (50 marks) Part two requires calculations to answer the questions. Furthermore, it requires qualitative explanations that convey your understanding of the concepts of risk and return of a portfolio. You are required to answer the following questions while providing deeper insights about the concepts of risk and return than those that are provided in the article. The table below gives information on three risky assets: A, B, and C. Standard Asset Expected Deviation Correlations return of the Return A B C A 11.5 23 1 0.25 0.4 B 14 43 0.25 1 0.15 C 18 58 0.4 0.15 1 There is also a risk-free asset F whose expected return is 9.9 percent. (i) Calculate the expected return and the standard deviation of Portfolio 1, which consists of 40 percent of Asset A and 60 percent of Asset B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts