Question: part 2 and 4 please. will give thumbs up Intro The current price of a non-dividend-paying stock is $67.99 and you expect the stock price

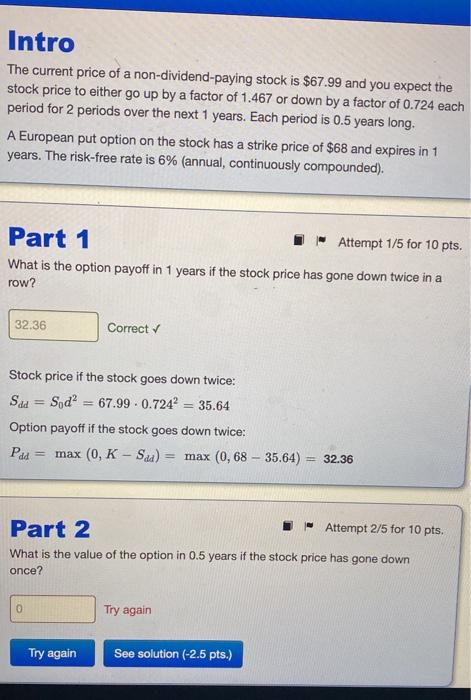

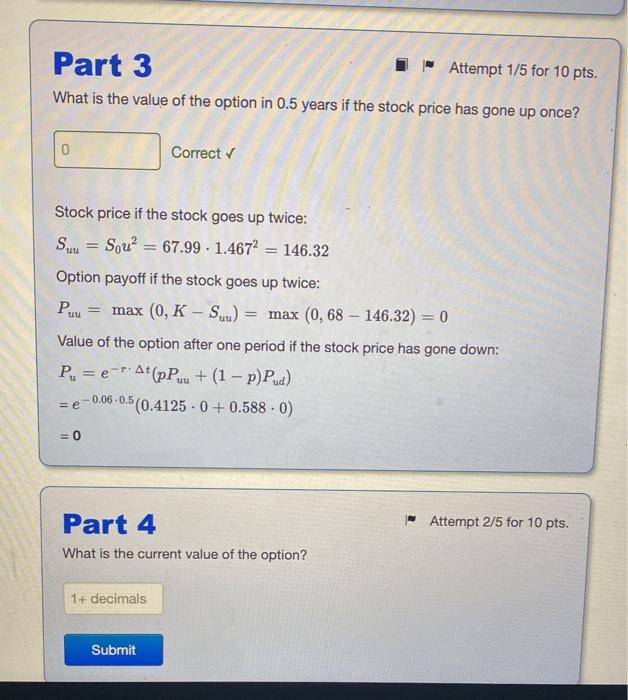

Intro The current price of a non-dividend-paying stock is $67.99 and you expect the stock price to either go up by a factor of 1.467 or down by a factor of 0.724 each period for 2 periods over the next 1 years. Each period is 0.5 years long, A European put option on the stock has a strike price of $68 and expires in 1 years. The risk-free rate is 6% (annual, continuously compounded). Part 1 Attempt 1/5 for 10 pts. What is the option payoff in 1 years if the stock price has gone down twice in row? 32.36 Correct Stock price if the stock goes down twice: Sad Soda = 67.99. 0.724? = 35.64 Option payoff if the stock goes down twice: Pad max (0, K - Su max (0,68 - 35.64) 32.36 Part 2 - Attempt 2/5 for 10 pts. What is the value of the option in 0.5 years if the stock price has gone down once? 0 Try again Try again See solution (-2.5 pts.) Part 3 - Attempt 1/5 for 10 pts. What is the value of the option in 0.5 years if the stock price has gone up once? 0 Correct Stock price if the stock goes up twice: Suu = Sou? = 67.99 - 1.4672 = 146.32 Option payoff if the stock goes up twice: max (0, K-Su) max (0,68 - 146.32) = 0 Value of the option after one period if the stock price has gone down: P = e-*At (pPuu + (1 - p)Pud) =e -0.06 -0.5 $(0.4125 . 0 + 0.588.0) Puu =0 - Attempt 2/5 for 10 pts. Part 4 What is the current value of the option? 1+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts