Question: Part 3 Analytics Assignment: Managerial Decision Making The following information applies to the questions displayed below.] These questions relate to the Integrated Analytics Case: Bene

![to the questions displayed below.] These questions relate to the Integrated Analytics](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66dffe0f45426_59866dffe0ea45a1.jpg)

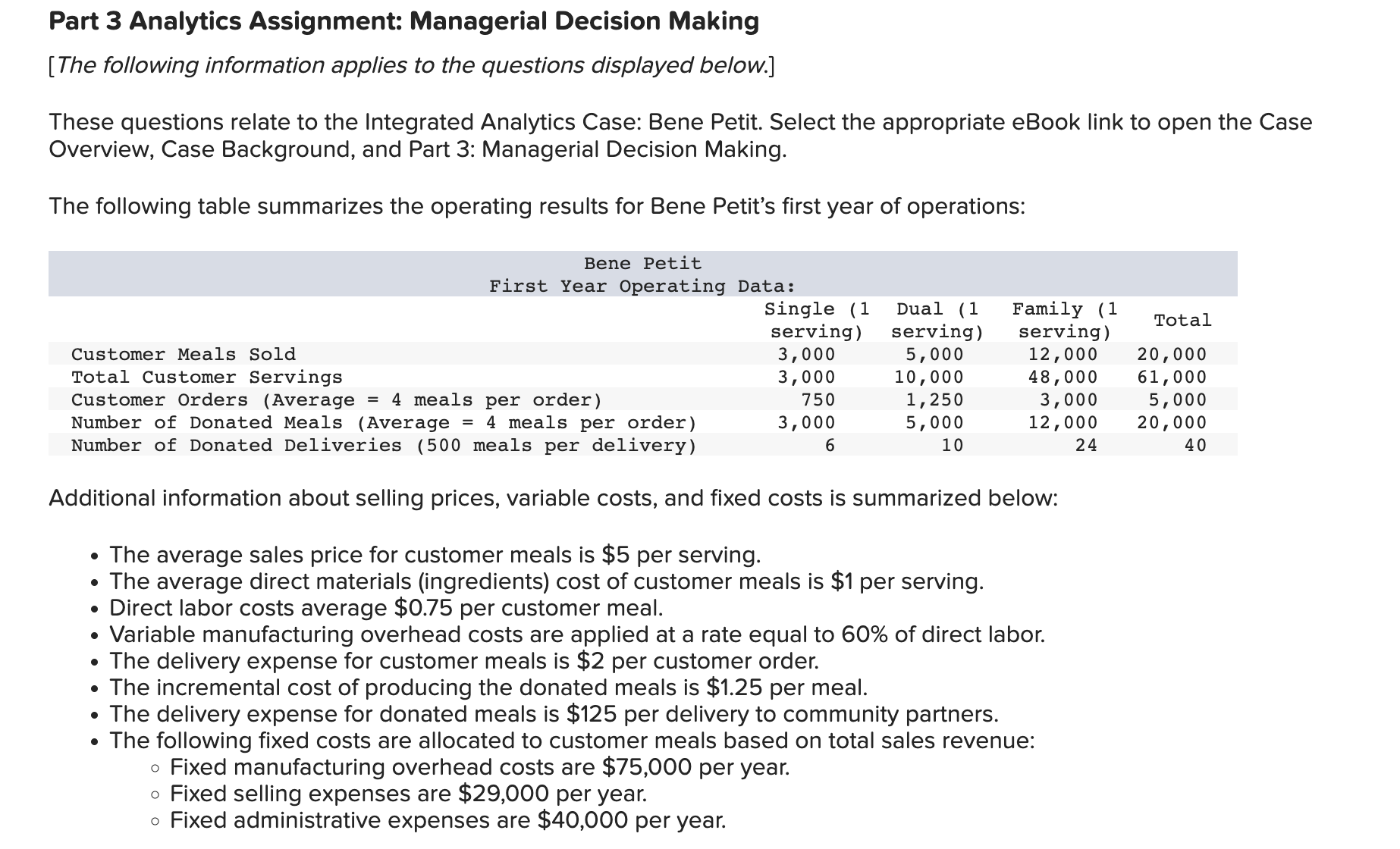

Part 3 Analytics Assignment: Managerial Decision Making The following information applies to the questions displayed below.] These questions relate to the Integrated Analytics Case: Bene Petit. Select the appropriate eBook link to open the Case Overview, Case Background, and Part 3: Managerial Decision Making. The following table summarizes the operating results for Bene Petit's first year of operations: Additional information about selling prices, variable costs, and fixed costs is summarized below: - The average sales price for customer meals is $5 per serving. - The average direct materials (ingredients) cost of customer meals is $1 per serving. - Direct labor costs average $0.75 per customer meal. - Variable manufacturing overhead costs are applied at a rate equal to 60% of direct labor. - The delivery expense for customer meals is $2 per customer order. - The incremental cost of producing the donated meals is $1.25 per meal. - The delivery expense for donated meals is \$125 per delivery to community partners. - The following fixed costs are allocated to customer meals based on total sales revenue: - Fixed manufacturing overhead costs are $75,000 per year. - Fixed selling expenses are $29,000 per year. - Fixed administrative expenses are $40,000 per year. Part 3 Analytics Assignment D: Cost-Volume Profit Analytics 4. Perform a "what if" analysis to see how operating results will change if sales increase by 12% during the second year of operations. a. What is the new net operating income? b. What is the new degree of operating leverage? c. If sales increased by 10% in the third year, what percentage growth in profit can the company expect? d. What is the predicted operating profit in year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts