Question: Part 4, Problems, 52 points, point values as indicated. Show Work. If using a financial calculator, write inputs. Assume face or par value bonds to

Part 4, Problems, 52 points, point values as indicated. Show Work. If using a financial calculator, write inputs. Assume face or par value bonds to be $1,000.

1. 12 points.You are looking at a 7-year 6% coupon bond that has a price of $900. Interest is paid annually. What is the yield to maturity of the bond?

2. 6 points. A credit card has an annual interest rate of 27% with daily compounding. What is the EAR?

Part 4, Continued

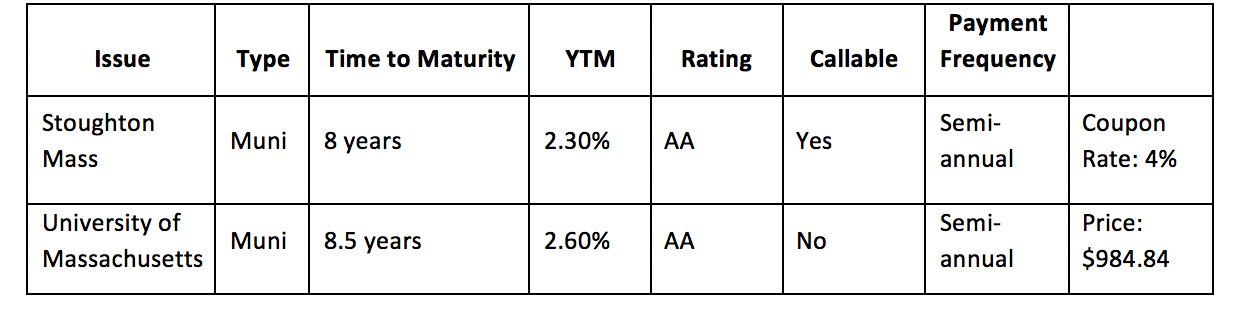

Use the information in the following table to answer the next 3 questions.

3. What is the price of the Stoughton Mass bond? . What is the coupon payment for the UMass bond?

4. What is the coupon rate for the UMass bond?

Part 4, Continued

Interest rates of a 1-year bond over the next five years are expected to be as follows: 5% (today),

6% (one year from now) ; 7% (two years from now) ; 8% (three years from now) ; 9% (four years from now).

Assume the liquidity premiums as follows:

2-year bond today: 0.5% ; 5-year bond today: 1% ; 3-year bond two years from now: 0.75%

Required:

Calculate the interest rate on a 2-year bond today, a 5-year bond today and the interest rate on a 3-year bond two years from now. (10 points)

There is no present value table

Issue Type Time to Maturity YTM Rating Payment Frequency Callable Stoughton Muni 8 years 2.30% AA Yes Semi- annual Coupon Rate: 4% Mass University of Massachusetts Muni 8.5 years 2.60% 4A Semi- annual Price: $984.84

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts