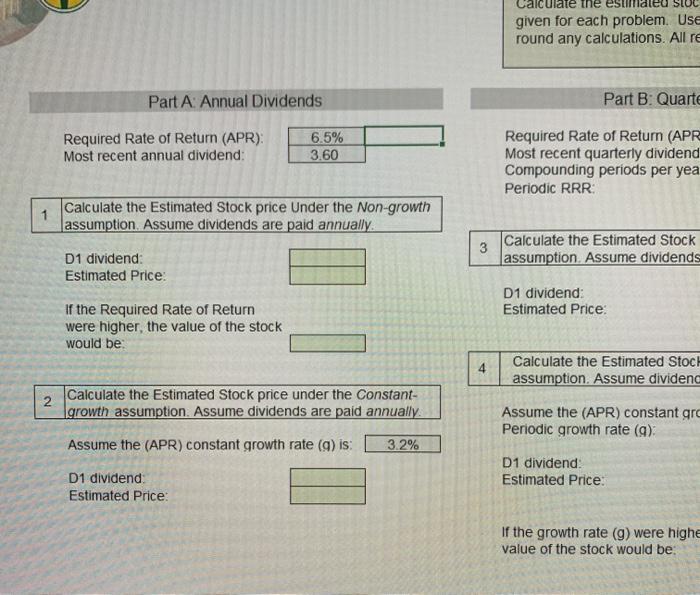

Question: Part A: Annual Dividends, with formulas please! alculate SLOC given for each problem. USE round any calculations. All re Part A Annual Dividends Part B.

alculate SLOC given for each problem. USE round any calculations. All re Part A Annual Dividends Part B. Quarto Required Rate of Return (APR): Most recent annual dividend: 6.5% 3.60 Required Rate of Return (APR Most recent quarterly dividend Compounding periods per yea Periodic RRR 1 Calculate the Estimated Stock price Under the Non-growth assumption. Assume dividends are paid annually 3 D1 dividend Estimated Price: Calculate the Estimated Stock assumption. Assume dividends D1 dividend: Estimated Price: If the Required Rate of Return were higher, the value of the stock would be 4 Calculate the Estimated Stock assumption. Assume dividend 2 Calculate the Estimated Stock price under the Constant- growth assumption. Assume dividends are paid annually Assume the (APR) constant grc Periodic growth rate (9) Assume the (APR) constant growth rate (g) is: 3.2% D1 dividend Estimated Price: D1 dividend Estimated Price: If the growth rate (g) were highe value of the stock would be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts