Question: Part C: Accounting Worksheet (26 marks) Amos has started his business on March 2020, and has furnished you with the following transactions: 2020 March 3

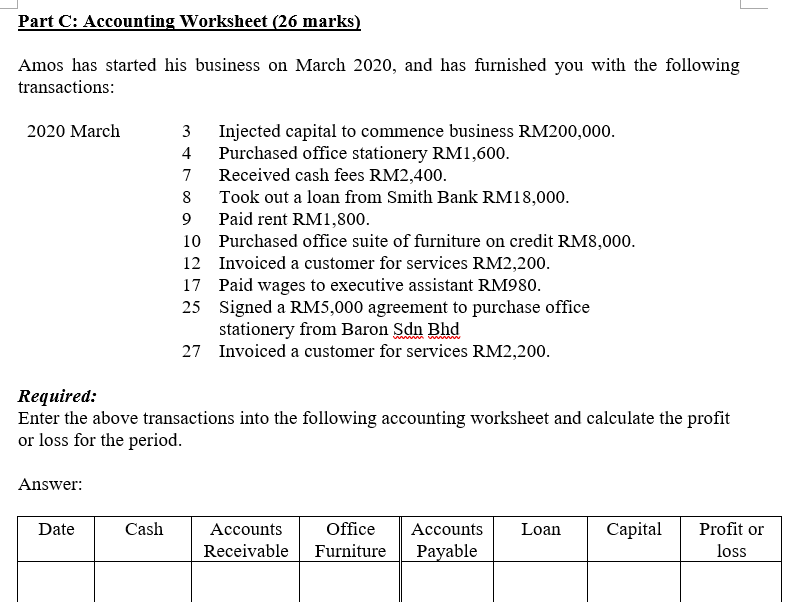

Part C: Accounting Worksheet (26 marks) Amos has started his business on March 2020, and has furnished you with the following transactions: 2020 March 3 Injected capital to commence business RM200,000. 4 Purchased office stationery RM1,600. 7 Received cash fees RM2,400. 8 Took out a loan from Smith Bank RM18,000. 9 Paid rent RM1,800. 10 Purchased office suite of furniture on credit RM8,000. 12 Invoiced a customer for services RM2,200. 17 Paid wages to executive assistant RM980. 25 Signed a RM5,000 agreement to purchase office stationery from Baron Sdn Bhd 27 Invoiced a customer for services RM2,200. Required: Enter the above transactions into the following accounting worksheet and calculate the profit or loss for the period. Answer: Date Cash Loan Capital Accounts Receivable Office Furniture Accounts Payable Profit or loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts