Question: Part D (2 marks) Lunas Ltd currently has no debt outstanding, and is entirely financed by $1 million of equity. The company is considering refinancing

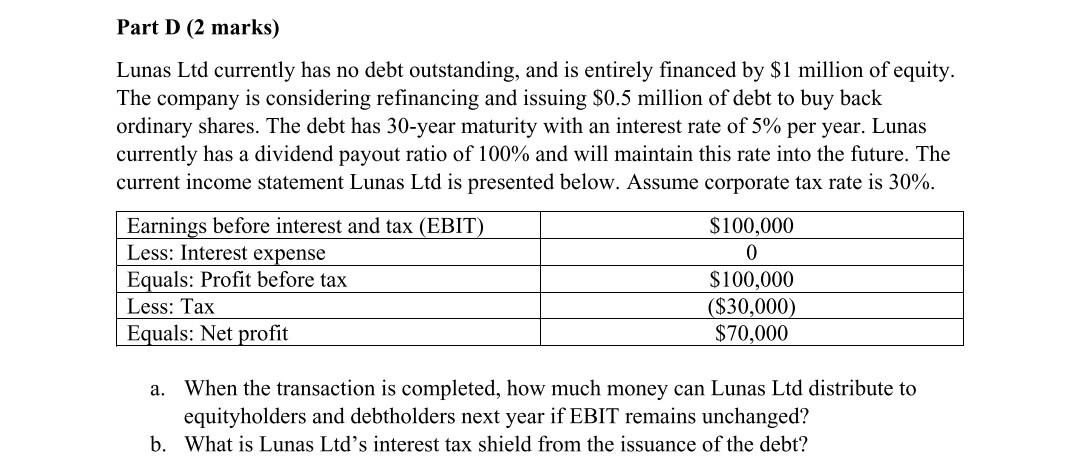

Part D (2 marks) Lunas Ltd currently has no debt outstanding, and is entirely financed by $1 million of equity. The company is considering refinancing and issuing $0.5 million of debt to buy back ordinary shares. The debt has 30-year maturity with an interest rate of 5% per year. Lunas currently has a dividend payout ratio of 100% and will maintain this rate into the future. The current income statement Lunas Ltd is presented below. Assume corporate tax rate is 30%. Earnings before interest and tax (EBIT) $100,000 0 Less: Interest expense Equals: Profit before tax $100,000 Less: Tax ($30,000) Equals: Net profit $70,000 a. When the transaction is completed, how much money can Lunas Ltd distribute to equityholders and debtholders next year if EBIT remains unchanged? b. What is Lunas Ltd's interest tax shield from the issuance of the debt

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock