Question: Question 1 Question 2 YongTai Sdn . Bhd . expects EBIT pf RM 2 , 0 0 0 , 0 0 0 for the coming

Question Question

YongTai Sdn Bhd expects EBIT pf RM for the coming year. The firm's capital

structure consists of dent and equity, and its marginal tax rate is The company

pays a rate on its RM of longterm debt. One million shares of common stock

are outstanding. In it next capital budgeting cycle, the firm expects to fund one large positive

NPV project costing RM and it will fund this project in accordance to its target capital

structure. If the firm follows a residual dividend policy and has no other project:

a What is its expected dividend payout ratio?

b What is the expected dividend per share? Question

In January the total assets of Kabel Pintas Berhad were RM million. The firm's

present capital structure, considered to be optimal is as follows:

New bonds with percent coupon were sold at par value. Ordinary shares currently trading at

RM per share can be issued by the company at RMI per share. Shareholders expect a rate

of return of percent dividend yield and percent growth in earnings. Retained earnings are

expected to be RM million. The corporate tax rate is Assume that the totalbudget for

asset expansion inclusive of fixed assets and working capital but exclusive of

depreciation is RM million.

a To maintain the present capital structure, how much of the capital budget must the company

finance by equity?

b How much of the required equity funds will be generated internally? Externally? Question

AJCroft Sdn Bhd currently has RM debt outstanding carrying a coupon atate of percent. Its

earnings before interest and taxes EBIT are RM and it is a zerogrowth company. The

company's cost of equity is percent, and its tax rate is The company has shares of

common stock outstanding. The dividend payout ratio is

AJCroft Sdn Bhd Is considering recalling the percent debt by issuing RM new percent debt.

The new funds would be used to replace the old debt and to repurchase stock at the existing price. It is

estimated that the increase in riskiness resulting from the leverage increase would cause the required

rate of return on equity to increase to percent. If this plan is carried out, what would be the company's

new stock price?Question

A consultant has collected the following information regarding Young Publishing:

The company has no growth opportunities so the company pays out all of its earnings as

dividends EPS DPS Young's stock price can be calculated by simply dividing earnings per share by

the required return on equity capital, which currently equals the WACC because the company has no debt.

The consultant believes that the company would be much better off if it were to change its capital

structure to percent debt and percent equity. After meeting with investment bankers, the consultant

concludes that the company could issue RM million of debt at a beforetax cost of percent, leaving

the company with interest expense of RM million. The RM million raised from the debt issue

would be used to repurchase stock at RM per share. The repurchase will have no effect on the firm's

EBIT; however, after the repurchase, the cost of equity will increase to percent. If the firm follows the

consultant's advice, what will be its estimated stock price after the capital structure change?

REQUIRED:

a Determine the current number of shares outstanding:

b Determine the number of shares after the repurchase:

c Determine the new EPS after the repurchase:

d Determine the new stock price:

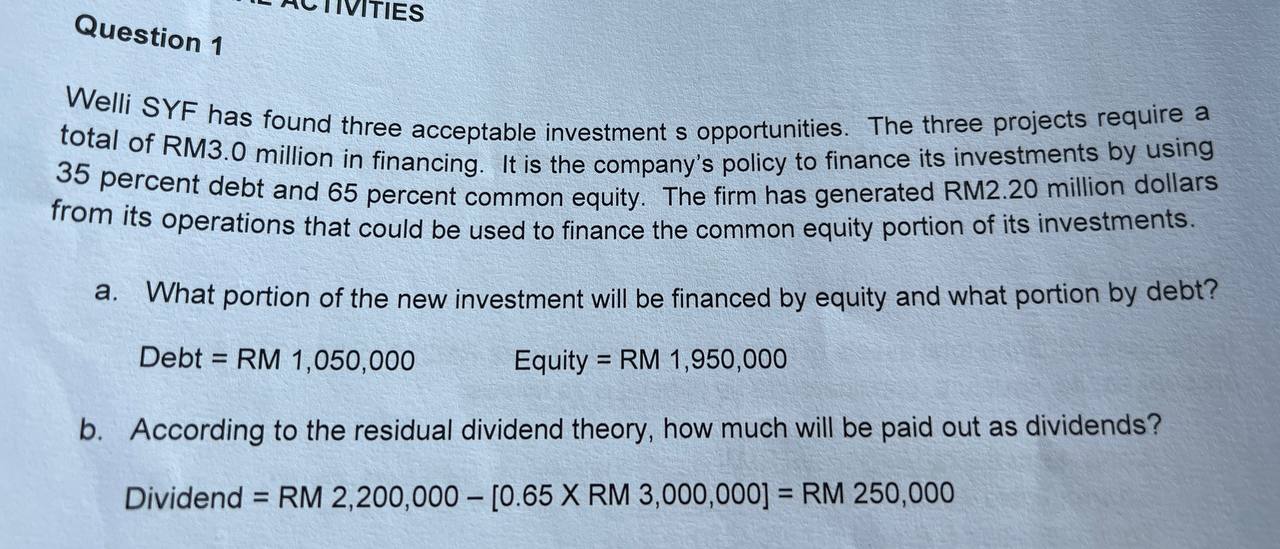

Welli SYF has found three acceptable investment s opportunities. The three projects require a

total of RM million in financing. It is the company's policy to finance its investments by using

percent debt and percent common equity. The firm has generated RM million dollars

from its operations that could be used to finance the common equity portion of its investments.

a What portion of the new investment will be financed by equity and what portion by debt?

Debt RM

Equity RM

b According to the residual dividend theory, how much will be paid out as dividends?

Dividend RM RM RM

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock