Question: Part I: MCQs 1. A security that has a beta of zero will have an expected return of: A. zero. B. the market risk premium.

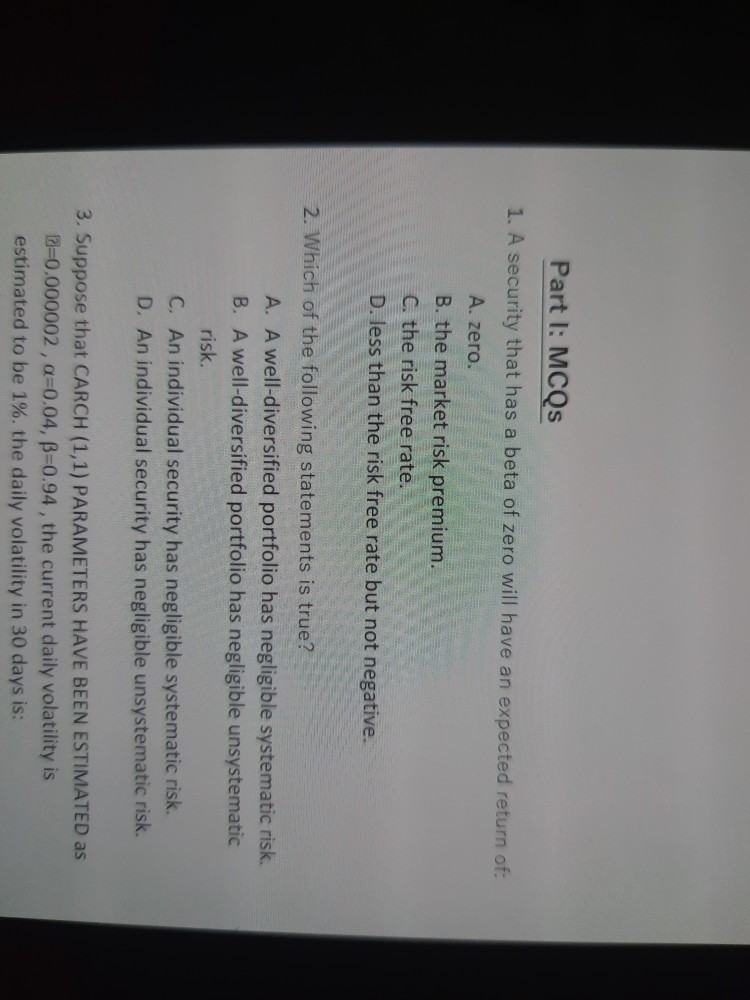

Part I: MCQs 1. A security that has a beta of zero will have an expected return of: A. zero. B. the market risk premium. C. the risk free rate. D. less than the risk free rate but not negative. 2. Which of the following statements is true? A. A well-diversified portfolio has negligible systematic risk. B. A well-diversified portfolio has negligible unsystematic risk. C. An individual security has negligible systematic risk. D. An individual security has negligible unsystematic risk. 3. Suppose that CARCH (1,1) PARAMETERS HAVE BEEN ESTIMATED as 3=0.000002, a=0.04, B=0.94, the current daily volatility is estimated to be 1%. the daily volatility in 30 days is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts