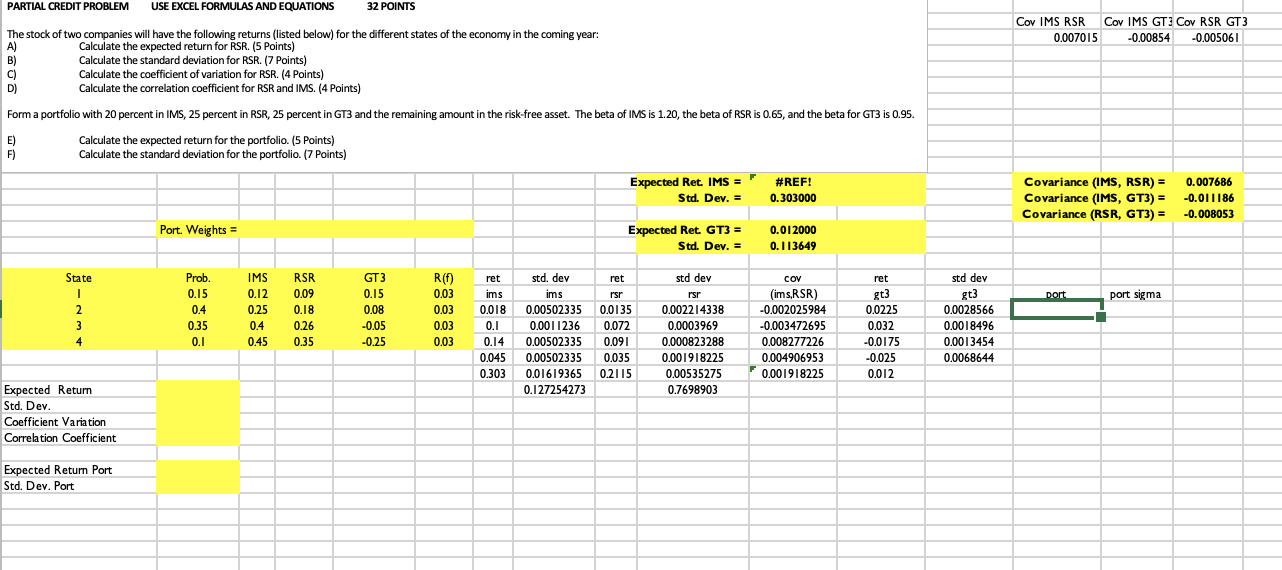

Question: PARTIAL CREDIT PROBLEM USE EXCEL FORMULAS AND EQUATIONS 32 POINTS Cov IMS RSR Cov IMS GT3 Cov RSR GT3 0.007015 -0.00854 -0.005061 The stock of

PARTIAL CREDIT PROBLEM USE EXCEL FORMULAS AND EQUATIONS 32 POINTS Cov IMS RSR Cov IMS GT3 Cov RSR GT3 0.007015 -0.00854 -0.005061 The stock of two companies will have the following returns (listed below) for the different states of the economy in the coming year: A) Calculate the expected return for RSR. (5 Points) B) Calculate the standard deviation for RSR. (7 points) c) Calculate the coefficient of variation for RSR. (4 Points) D) Calculate the correlation coefficient for RSR and IMS. (4 points) Form a portfolio with 20 percent in IMS, 25 percent in RSR, 25 percent in GT3 and the remaining amount in the risk-free asset. The beta of IMS is 1.20, the beta of RSR is 0.65, and the beta for GT3 is 0.95. E) E F) Calculate the expected return for the portfolio. (5 Points) Calculate the standard deviation for the portfolio (7 Points) Expected Ret. IMS = Std. Dev. = #REF! 0.303000 Covariance (IMS, RSR) = Covariance (IMS, GT3) = Covariance (RSR, GT3) = 0.007686 -0.011186 -0.008053 Port. Weights = Expected Ret. GT3 = Std. Dev. = 0.012000 0.113649 Prob. Dort port sigma State I 2 3 4 0.15 0.4 0.35 0.1 IMS 0.12 0.25 0.4 0.45 RSR 0.09 0.18 0.26 0.35 GT3 0.15 0.08 -0,05 -0.25 R() 0.03 0.03 0.03 0.03 ret ims 0.018 0.1 0.14 0.045 0.303 std. dev ims 0.00502335 0.0011236 0.00502335 0.00502335 0.01619365 0.127254273 ret Tel rsr 0.0135 0.072 0.091 0.035 0.2115 std dev rsr 0.002214338 0.0003969 0.000823288 0.001918225 0.00535275 0.7698903 COV (ims,RSR) () -0.002025984 -0.003472695 0.008277226 0.004906953 0.001918225 ret gt3 0.0225 0.032 -0.0175 -0.025 0.012 std dev gt3 0.0028566 0.0018496 0.0013454 0.0068644 Expected Return Std. Dev. Coefficient Variation Correlation Coefficient Expected Return Port Std. Dev. Port PARTIAL CREDIT PROBLEM USE EXCEL FORMULAS AND EQUATIONS 32 POINTS Cov IMS RSR Cov IMS GT3 Cov RSR GT3 0.007015 -0.00854 -0.005061 The stock of two companies will have the following returns (listed below) for the different states of the economy in the coming year: A) Calculate the expected return for RSR. (5 Points) B) Calculate the standard deviation for RSR. (7 points) c) Calculate the coefficient of variation for RSR. (4 Points) D) Calculate the correlation coefficient for RSR and IMS. (4 points) Form a portfolio with 20 percent in IMS, 25 percent in RSR, 25 percent in GT3 and the remaining amount in the risk-free asset. The beta of IMS is 1.20, the beta of RSR is 0.65, and the beta for GT3 is 0.95. E) E F) Calculate the expected return for the portfolio. (5 Points) Calculate the standard deviation for the portfolio (7 Points) Expected Ret. IMS = Std. Dev. = #REF! 0.303000 Covariance (IMS, RSR) = Covariance (IMS, GT3) = Covariance (RSR, GT3) = 0.007686 -0.011186 -0.008053 Port. Weights = Expected Ret. GT3 = Std. Dev. = 0.012000 0.113649 Prob. Dort port sigma State I 2 3 4 0.15 0.4 0.35 0.1 IMS 0.12 0.25 0.4 0.45 RSR 0.09 0.18 0.26 0.35 GT3 0.15 0.08 -0,05 -0.25 R() 0.03 0.03 0.03 0.03 ret ims 0.018 0.1 0.14 0.045 0.303 std. dev ims 0.00502335 0.0011236 0.00502335 0.00502335 0.01619365 0.127254273 ret Tel rsr 0.0135 0.072 0.091 0.035 0.2115 std dev rsr 0.002214338 0.0003969 0.000823288 0.001918225 0.00535275 0.7698903 COV (ims,RSR) () -0.002025984 -0.003472695 0.008277226 0.004906953 0.001918225 ret gt3 0.0225 0.032 -0.0175 -0.025 0.012 std dev gt3 0.0028566 0.0018496 0.0013454 0.0068644 Expected Return Std. Dev. Coefficient Variation Correlation Coefficient Expected Return Port Std. Dev. Port

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts