Question: payroll set up and payroll processing match activities with the framework for navigation QBO payroll. Match the activities provided in the drop-down boxes below with

payroll set up and payroll processing match activities with the framework for navigation QBO payroll.

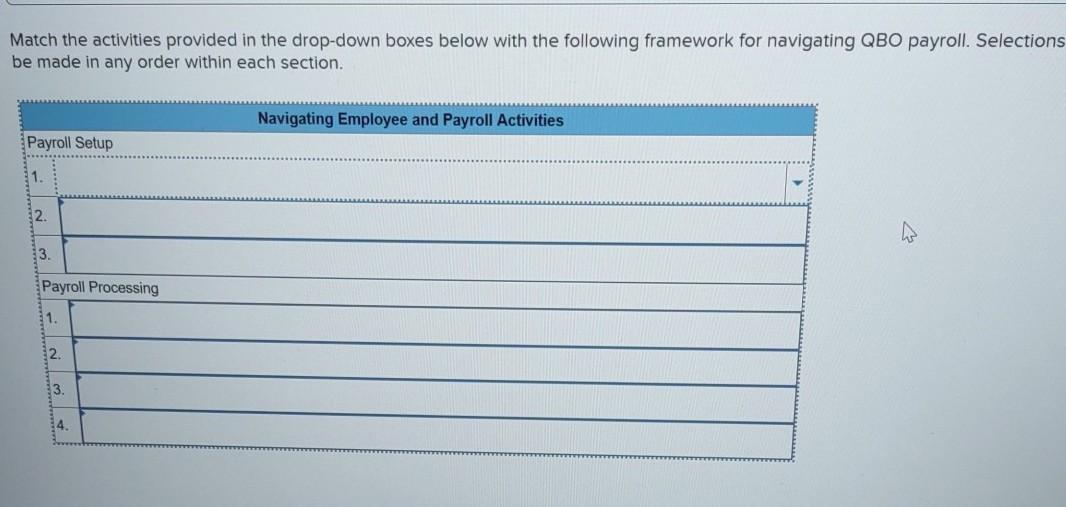

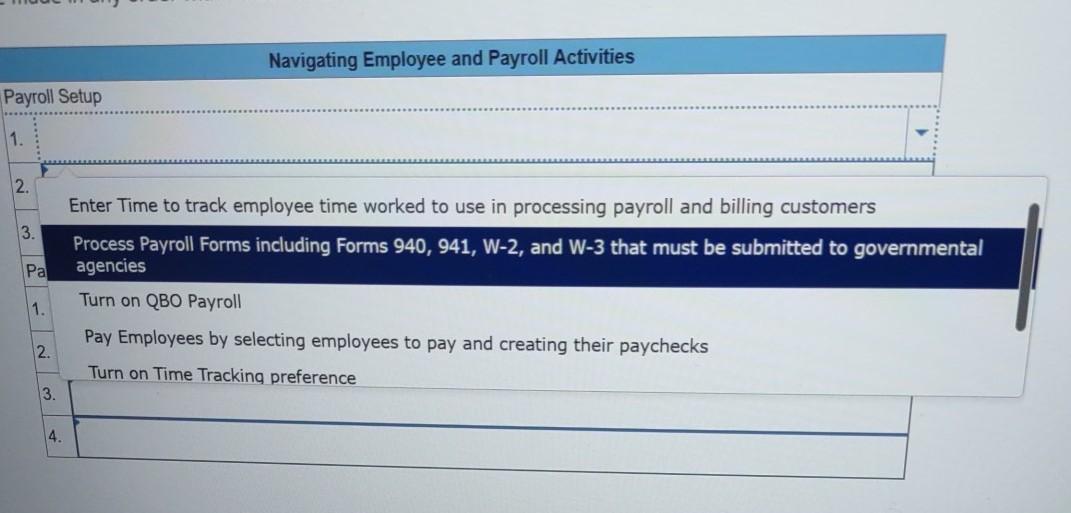

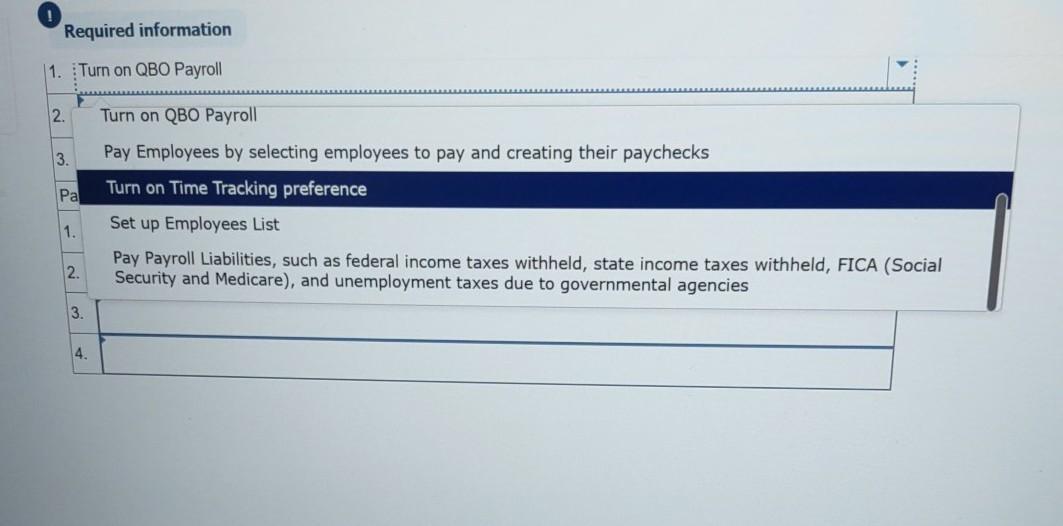

Match the activities provided in the drop-down boxes below with the following framework for navigating QBO payroll. Selections be made in any order within each section. Navigating Employee and Payroll Activities Payroll Setup 1. 2. 13 Payroll Processing 1. 2. 3. 14 Navigating Employee and Payroll Activities Payroll Setup 1. 2. 3. Enter Time to track employee time worked to use in processing payroll and billing customers Process Payroll Forms including Forms 940, 941, W-2, and W-3 that must be submitted to governmental agencies Turn on QBO Payroll Pa 1. 2. Pay Employees by selecting employees to pay and creating their paychecks Turn on Time Tracking preference 3. 4. Required information 1. Turn on QBO Payroll 2. 3. Pa Turn on QBO Payroll Pay Employees by selecting employees to pay and creating their paychecks Turn on Time Tracking preference Set up Employees List Pay Payroll Liabilities, such as federal income taxes withheld, state income taxes withheld, FICA (Social Security and Medicare), and unemployment taxes due to governmental agencies 1. 2. 3. 4. Match the activities provided in the drop-down boxes below with the following framework for navigating QBO payroll. Selections be made in any order within each section. Navigating Employee and Payroll Activities Payroll Setup 1. 2. 13 Payroll Processing 1. 2. 3. 14 Navigating Employee and Payroll Activities Payroll Setup 1. 2. 3. Enter Time to track employee time worked to use in processing payroll and billing customers Process Payroll Forms including Forms 940, 941, W-2, and W-3 that must be submitted to governmental agencies Turn on QBO Payroll Pa 1. 2. Pay Employees by selecting employees to pay and creating their paychecks Turn on Time Tracking preference 3. 4. Required information 1. Turn on QBO Payroll 2. 3. Pa Turn on QBO Payroll Pay Employees by selecting employees to pay and creating their paychecks Turn on Time Tracking preference Set up Employees List Pay Payroll Liabilities, such as federal income taxes withheld, state income taxes withheld, FICA (Social Security and Medicare), and unemployment taxes due to governmental agencies 1. 2. 3. 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts