Question: PB13-2 Analyzing Comparative Financial Statements Using Selected Ratios [LO 13-4, LO 13-5] The comparative financial statements prepared at December 31 for Tiger Audio showed the

![13-5] The comparative financial statements prepared at December 31 for Tiger Audio](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e7254876baf_39166e72547ecc0e.jpg)

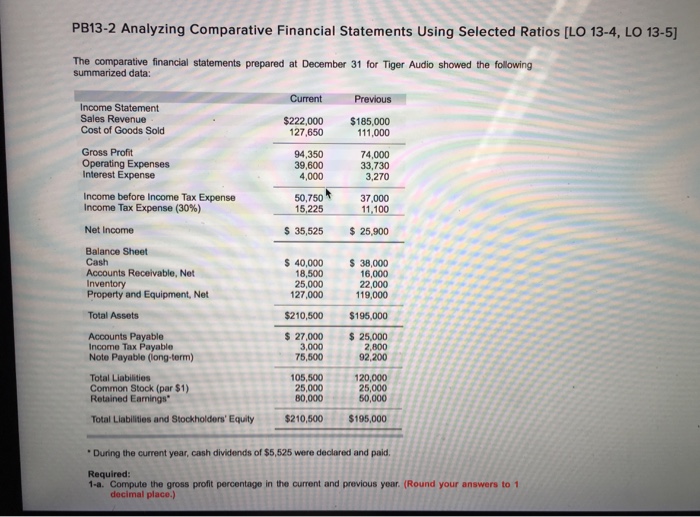

PB13-2 Analyzing Comparative Financial Statements Using Selected Ratios [LO 13-4, LO 13-5] The comparative financial statements prepared at December 31 for Tiger Audio showed the folowing summarized data Income Statement Sales Revenue $222,000 $185,000 Cost of Goods Sold 127,650 111,000 Gross Profit 94,350 74,000 Operating Expenses 39,600 33,730 Interest Expense 4,000 3.270 Income before Income Tax Expense 50,750 37.000 Income Tax Expense (30%) 15,225 11,100 35,525 25,900 Net Income Balance Sheet 40,000 38,000 Net 16,000 18,500 inventory 25,000 22.000 Property and Equipment, Net 127,000 119,000 Total Assets $210,500 $195,000 27,000 25,000 Accounts Payable Income Tax Payable 3,000 2,800 Note Payable (ong-term) 75,500 Total Liabilities 105,500 120,000 Common Stock (par $1) 25,000 25,000 Retained Earnings 80,000 50,000 Total Liabilities and Stockholders' Equity $210,500 $195,000 During the current year, cash dividends of$5,525 were declared and paid Required 1-a. Compute the gross profit percentage in the current and previous year. (Round your answers to 1 decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts