Question: Perform a financial analysis for a project using the format provided in Figure 4-5. Assume that the projected costs and benefits for this project are

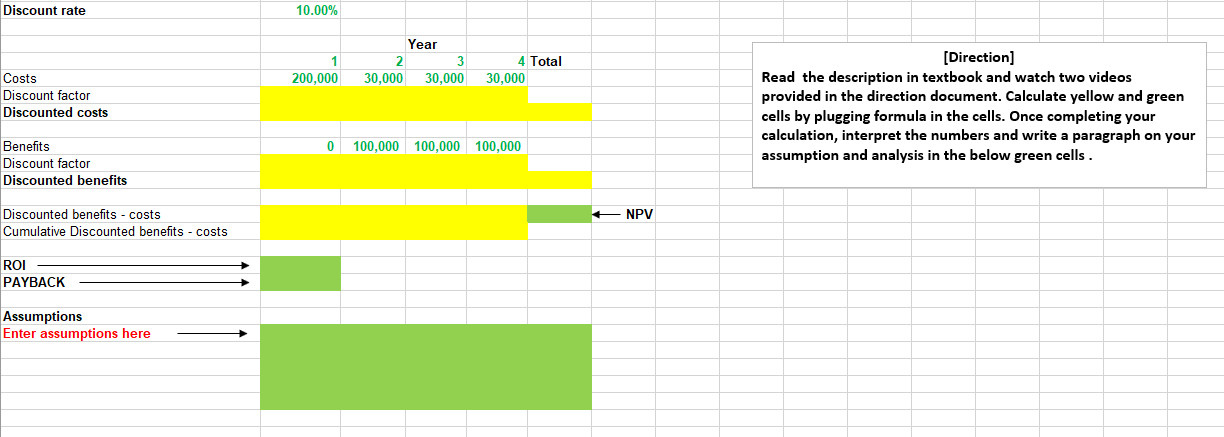

Perform a financial analysis for a project using the format provided in Figure 4-5. Assume that the projected costs and benefits for this project are spread over four years as follows: Estimated costs are $200,000 in Year 1 and $30,000 each year in Years 2, 3, and 4. Estimated benefits are $0 in Year 1 and $100,000 each year in Years 2, 3, and 4. Use a 10 percent discount rate, and round the discount factors to two decimal places. Create a spreadsheet or use the business case financials template on the companion website to calculate and clearly display the NPV, ROI, and year in which payback occurs. In addition, write a paragraph explaining whether you would recommend investing in this project, based on your financial analysis

Discount rate 10.00% Year 2 3 30,000 30,000 200,000 4 Total 30,000 Costs Discount factor Discounted costs [Direction] Read the description in textbook and watch two videos provided in the direction document. Calculate yellow and green cells by plugging formula in the cells. Once completing your calculation, interpret the numbers and write a paragraph on your assumption and analysis in the below green cells. 0 100,000 100,000 100,000 Benefits Discount factor Discounted benefits NPV Discounted benefits - costs Cumulative Discounted benefits - costs ROI PAYBACK Assumptions Enter assumptions here Discount rate 10.00% Year 2 3 30,000 30,000 200,000 4 Total 30,000 Costs Discount factor Discounted costs [Direction] Read the description in textbook and watch two videos provided in the direction document. Calculate yellow and green cells by plugging formula in the cells. Once completing your calculation, interpret the numbers and write a paragraph on your assumption and analysis in the below green cells. 0 100,000 100,000 100,000 Benefits Discount factor Discounted benefits NPV Discounted benefits - costs Cumulative Discounted benefits - costs ROI PAYBACK Assumptions Enter assumptions here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts