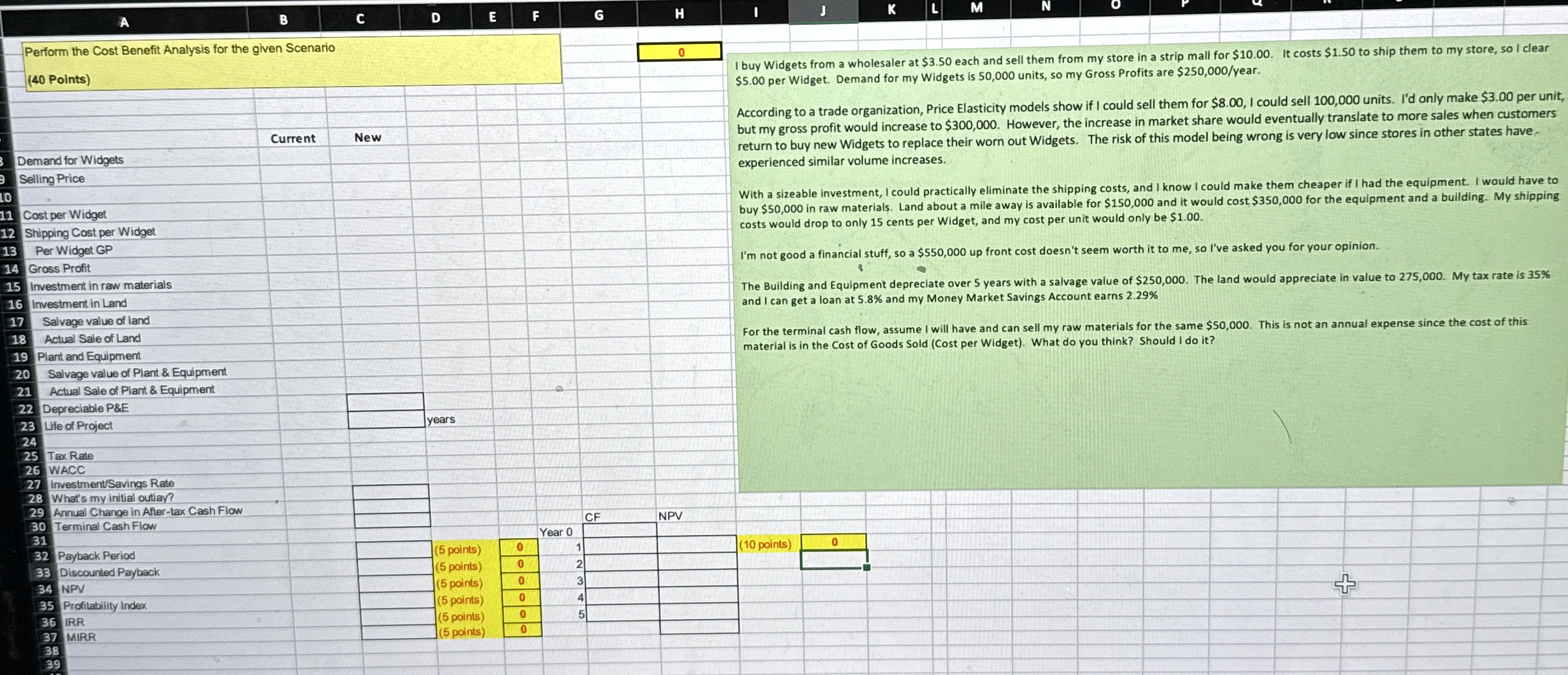

Question: Perform the Cost Benefit Analysis for the given Scenario ( 4 0 Points ) Cost per Widget 2 Shipping Cost per Widget Per Widget GP

Perform the Cost Benefit Analysis for the given Scenario

Points

Cost per Widget

Shipping Cost per Widget

Per Widget GP

Gross Profit

Investment in raw materials

Investment in Land

Salvage value of land

Actual Sale of Land

Plant and Equipment

tablePlant and EquipmentPalivage value of Plant & EquipmentActual Sale of Plant & Equipment,,,tableActual Sale of Plant & EquipmentDepreciable P&Efe of Project,,,years,,,,ax Rate,,,,,,,NACC,,,,,,,InvestmenSSavings Rate,,,,,,,tableWhats my initial outlay?Annual Change in Aftertax Cash FlowWItableTerminal CashFlow,,,,,,CFNPVPayback Period,,, points moints tableDiscounted Payback,,,table points pointsNPVtable points pointsfccafefcfeffProfitability index,,,,IRR,,, pointsMIRR,,, points

I buy Widgets from a wholesaler at $ each and sell them from my store in a strip mall for $ It costs $ to ship them to my store, so I clear $ per Widget. Demand for my Widgets is units, so my Gross Profits are $ year.

According to a trade organization, Price Elasticity models show if I could sell them for $ I could sell units. Id only make $ per unit, but my gross profit would increase to $ However, the increase in market share would eventually translate to more sales when customers return to buy new Widgets to replace their worn out Widgets. The risk of this model being wrong is very low since stores in other states have experienced similar volume increases.

With a sizeable investment, I could practically eliminate the shipping costs, and I know I could make them cheaper if I had the equipment. I would have to buy $ in raw materials. Land about a mile away is available for $ and it would cost $ for the equipment and a building. My shipping costs would drop to only cents per Widget, and my cost per unit would only be $

Im not good a financial stuff, so a $ up front cost doesn't seem worth it to me so I've asked you for your opinion.

The Building and Equipment depreciate over years with a salvage value of $ The land would appreciate in value to My tax rate is and I can get a loan at and my Money Market Savings Account earns

For the terminal cash flow, assume I will have and can sell my raw materials for the same $ This is not an annual expense since the cost of this material is in the Cost of Goods Sold Cost per Widget What do you think? Should I do it

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock