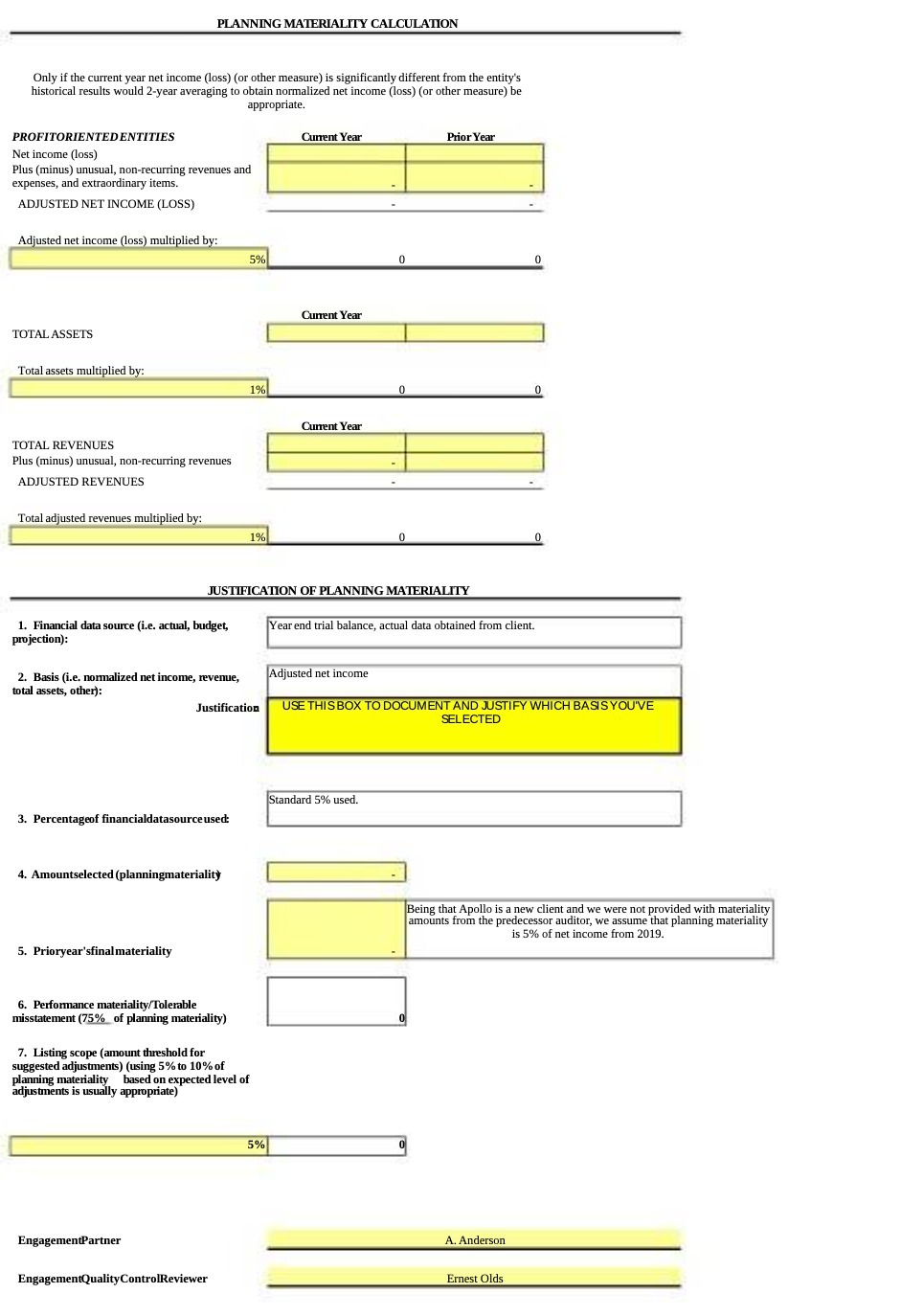

Question: PLANNING MATERIALITY CALCULATION Only if the current year net income (loss) (or other measure) is significantly different from the entity's historical results would 2-year averaging

PLANNING MATERIALITY CALCULATION Only if the current year net income (loss) (or other measure) is significantly different from the entity's historical results would 2-year averaging to obtain normalized net income (loss) (or other measure) be appropriate. PROFITORIENTED ENTITIES Current Year Prior Year Net income (loss) Plus (minus) unusual, non-recurring revenues and expenses, and extraordinary items. ADJUSTED NET INCOME (LOSS) Adjusted net income (loss) multiplied by: 5% 0 Current Year TOTAL ASSETS Total assets multiplied by: 1% 0 Current Year TOTAL REVENUES Plus (minus) unusual, non-recurring revenues ADJUSTED REVENUES Total adjusted revenues multiplied by: 1% JUSTIFICATION OF PLANNING MATERIALITY 1. Financial data source (i.e. actual, budget, Year end trial balance, actual data obtained from client. projection): 2. Basis (i.e. normalized net income, revenue, Adjusted net income total assets, other): Justification USE THIS BOX TO DOCUMENT AND JUSTIFY WHICH BASIS YOU'VE SELECTED Standard 5% used. 3. Percentageof financialdatasource used: 4. Amountselected (planningmateriality Being that Apollo is a new client and we were not provided with materiality amounts from the predecessor auditor, we assume that planning materiality is 5% of net income from 2019. 5. Prioryear'sfinal materiality 6. Performance materiality/Tolerable misstatement (75% of planning materiality) 7. Listing scope (amount threshold for suggested adjustments) (using 5% to 10% of planning materiality based on expected level of adjustments is usually appropriate) 5% EngagementPartner A. Anderson EngagementQuality ControlReviewer Ernest Olds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts