Question: Problem 1 (16 points) Jim Jacobs is negotiating with a Venture Capital Fund for $ 4 MIL financ a t he must Jim is the

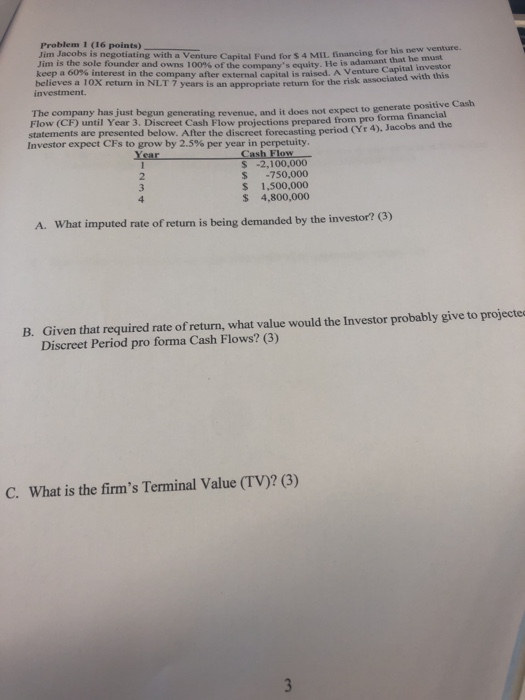

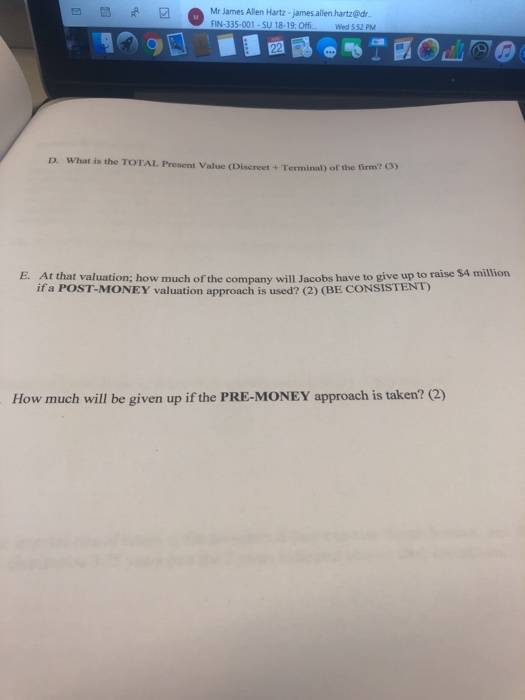

Problem 1 (16 points) Jim Jacobs is negotiating with a Venture Capital Fund for $ 4 MIL financ a t he must Jim is the sole founder and owns 100% of the company's equity. He is adamar Venture Capital investor keep a interest in the company after external capital is raised. A Venue believes a 10X return in NLT 7 years is an appropriate return for the risk associated w investment. The company has just begun generating revenue and it does not expect to generate positive Cash Flow (CF) until Year 3. Discreet Cash Flow projections prepared from pro forma financia statements are presented below. After the discreet forecasting period (Yr 4). Jacobs and the Investor expect CFs to grow by 2.5% per year in perpetuity. Year Cash Flow $ -2.100.000 $ -750,000 $ 1,500,000 $ 4.800,000 A. What imputed rate of return is being demanded by the investor? (3) B. Given that required rate of return, what value would the Investor probably give to projecte Discreet Period pro forma Cash Flows? (3) C. What is the firm's Terminal Value (TV)? (3) A A Mr James Allen Hartz james allen hartz@dr. FIN-335-001 - SU 18-19: Off Wed 552 PM D. What is the TOTAL Present Value (Discreet Terminal of the firm'? 3) E. At that valuation: how much of the company will lacobs have to give up to raise S4 million if a POST-MONEY valuation anproach is used2 (2) (BE CONSISTENI) How much will be given up if the PRE-MONEY approach is taken? (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts