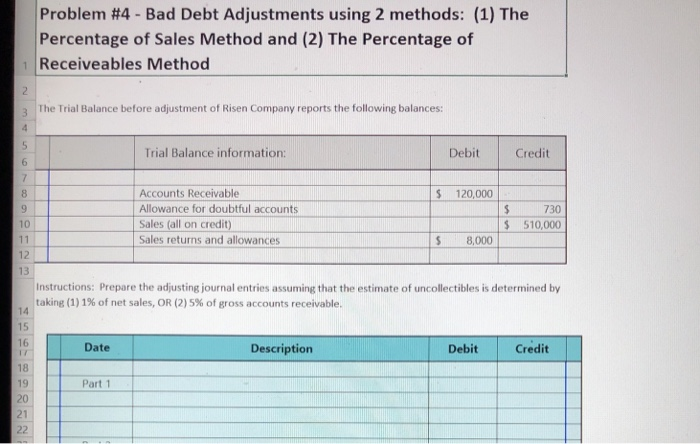

Question: Pleas help and show any work, thank you! Problem #4-Bad Debt Adjustments using 2 methods: (1) The Percentage of Sales Method and (2) The Percentage

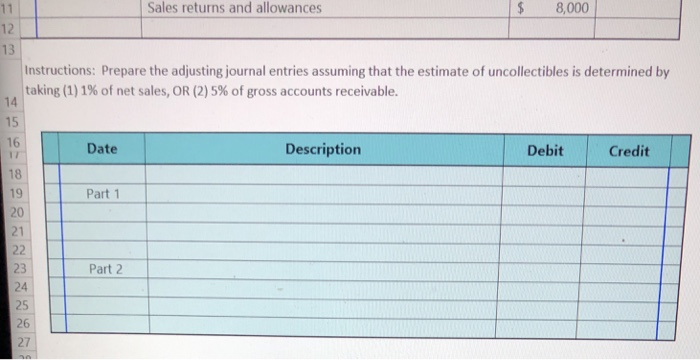

Problem #4-Bad Debt Adjustments using 2 methods: (1) The Percentage of Sales Method and (2) The Percentage of Receiveables Method 3 The Trial Balance before adjustment of Risen Company reports the following balances: Trial Balance information: DebitCredit 6 Accounts Receivable Allowance for doubtful accounts Sales (all on credit) Sales returns and allowances S 120,000 730 510,000 10 S 8,000 13 Instructions: Prepare the adjusting journal entries assuming that the estimate of uncollectibles is determined by taking (1) 1% of net sales, OR (2) 5% of gross accounts receivable. 14 15 16 Date Description Debit Credit 18 19 20 21 Part 1 $ 8,000 Sales returns and allowances 12 13 Instructions: Prepare the adjusting journal entries assuming that the estimate of uncollectibles is determined by taking (1) 1% of net sales, OR (2) 5% of gross accounts receivable. 14 15 16 Date Description Debit Credit 18 19 20 21 Part 1 Part 2 23 24 25 26 27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts