Question: Pleas help need it ASAP Use the information below to answer questions 16 - 20: Patrick's Pizza has come up with a new product, Pizza

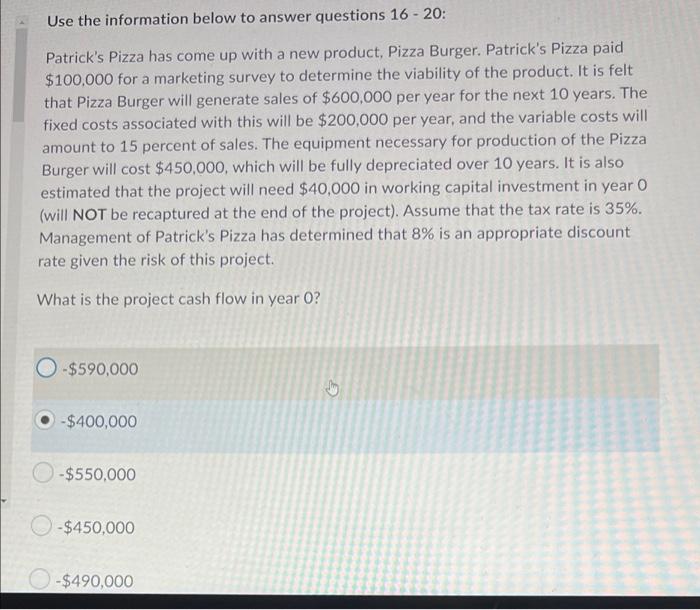

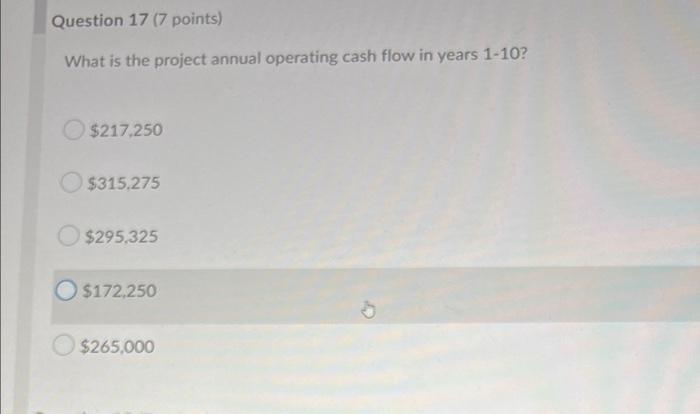

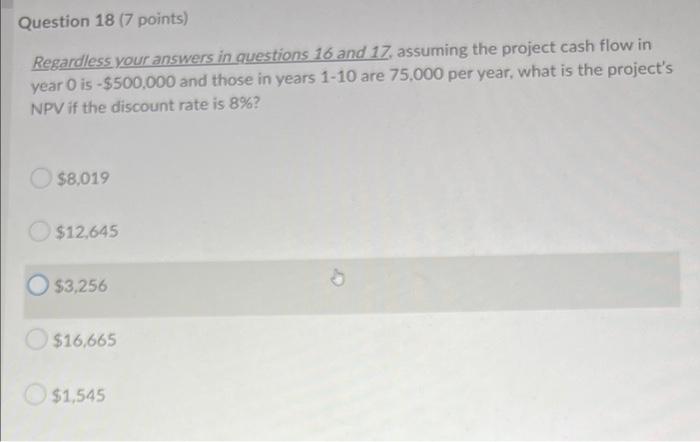

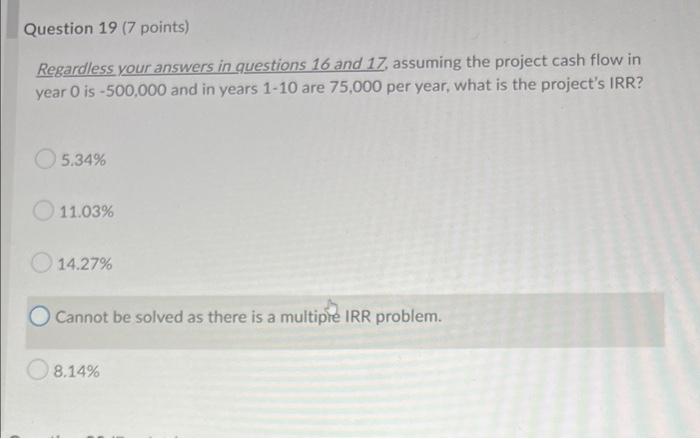

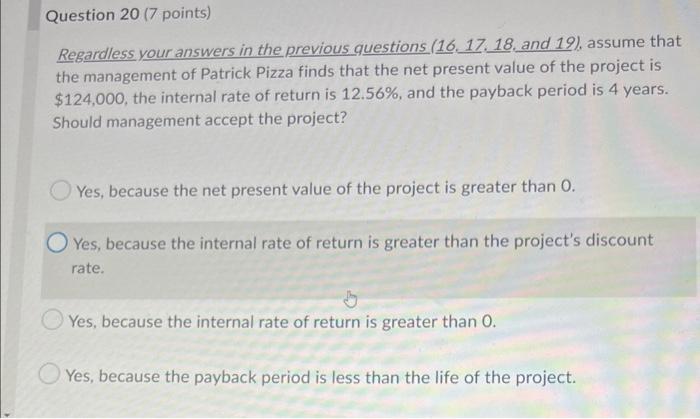

Use the information below to answer questions 16 - 20: Patrick's Pizza has come up with a new product, Pizza Burger. Patrick's Pizza paid $100,000 for a marketing survey to determine the viability of the product. It is felt that Pizza Burger will generate sales of $600,000 per year for the next 10 years. The fixed costs associated with this will be $200,000 per year, and the variable costs will amount to 15 percent of sales. The equipment necessary for production of the Pizza Burger will cost $450,000, which will be fully depreciated over 10 years. It is also estimated that the project will need $40,000 in working capital investment in year o (will NOT be recaptured at the end of the project). Assume that the tax rate is 35%. Management of Patrick's Pizza has determined that 8% is an appropriate discount rate given the risk of this project. What is the project cash flow in year 0? 0-$590,000 -$400,000 -$550,000 -$450,000 -$490,000 Question 17 (7 points) What is the project annual operating cash flow in years 1-10? $217.250 $315,275 $295,325 $172,250 $265.000 Question 18 (7 points) Regardless your answers in questions 16 and 17 assuming the project cash flow in year is -$500,000 and those in years 1-10 are 75,000 per year, what is the project's NPV if the discount rate is 8%? $8,019 $12,645 $3,256 $16,665 $1,545 Question 19 (7 points) Regardless your answers in questions 16 and 17, assuming the project cash flow in year Ois-500,000 and in years 1-10 are 75,000 per year, what is the project's IRR? 5.34% 11.03% 14.27% Cannot be solved as there is a multiple IRR problem. 8.14% Question 20 (7 points) Regardless your answers in the previous questions (16. 17. 18. and 19), assume that the management of Patrick Pizza finds that the net present value of the project is $124,000, the internal rate of return is 12.56%, and the payback period is 4 years. Should management accept the project? Yes, because the net present value of the project is greater than 0. Yes, because the internal rate of return is greater than the project's discount rate. Yes, because the internal rate of return is greater than 0. Yes, because the payback period is less than the life of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts