Question: Please analyze the data in the Spreadsheet 10.1 provided below and change the relevant selected input variables of bond characteristics (including annual coupon rate) but

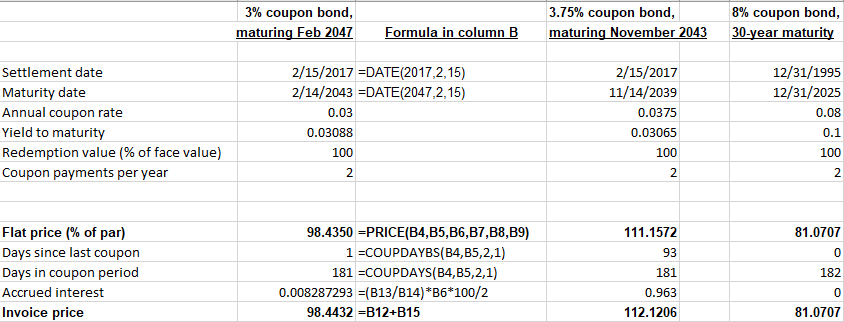

Please analyze the data in the Spreadsheet 10.1 provided below and change the relevant selected input variables of bond characteristics (including annual coupon rate) but realistically, and following the market conventions for quoting bonds) for each bond separately to get the Invoice price of 77, 97 and 146 respectively for the first, the second and the third bond in the table (as close as possible due to implied limitations).

3% coupon bond, maturing Feb 2047 3.75% coupon bond, maturing November 2043 8% coupon bond, 30-year maturity Formula in column B Settlement date Maturity date Annual coupon rate Yield to maturity Redemption value (% of face value) Coupon payments per year 2/15/2017 =DATE(2017,2,15) 2/14/2043 =DATE(2047,2,15) 0.03 0.03088 100 2 2/15/2017 11/14/2039 0.0375 0.03065 100 12/31/1995 12/31/2025 0.08 0.1 100 2 2 111.1572 81.0707 0 93 Flat price (% of par) Days since last coupon Days in coupon period Accrued interest Invoice price 98.4350 =PRICE(B4,B5,B6,B7,38,39) 1 =COUPDAYBS(B4,B5,2,1) 181 =COUPDAYS(B4,B5,2,1) 0.008287293 = (B13/B14) *B6*100/2 98.4432 =B12+B15 181 182 0 0.963 112.1206 81.0707 3% coupon bond, maturing Feb 2047 3.75% coupon bond, maturing November 2043 8% coupon bond, 30-year maturity Formula in column B Settlement date Maturity date Annual coupon rate Yield to maturity Redemption value (% of face value) Coupon payments per year 2/15/2017 =DATE(2017,2,15) 2/14/2043 =DATE(2047,2,15) 0.03 0.03088 100 2 2/15/2017 11/14/2039 0.0375 0.03065 100 12/31/1995 12/31/2025 0.08 0.1 100 2 2 111.1572 81.0707 0 93 Flat price (% of par) Days since last coupon Days in coupon period Accrued interest Invoice price 98.4350 =PRICE(B4,B5,B6,B7,38,39) 1 =COUPDAYBS(B4,B5,2,1) 181 =COUPDAYS(B4,B5,2,1) 0.008287293 = (B13/B14) *B6*100/2 98.4432 =B12+B15 181 182 0 0.963 112.1206 81.0707

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts