Question: Please Answer 1-10!! This questions has been asked before on chegg, PLEASE DO NOT copy and paste the response from that question and use it

Please Answer 1-10!!

This questions has been asked before on chegg, PLEASE DO NOT copy and paste the response from that question and use it to answer it on mine. It is INCORRECT so I will downvote you. This is my 2nd time trying to get this question answered correctly.

Show all work.

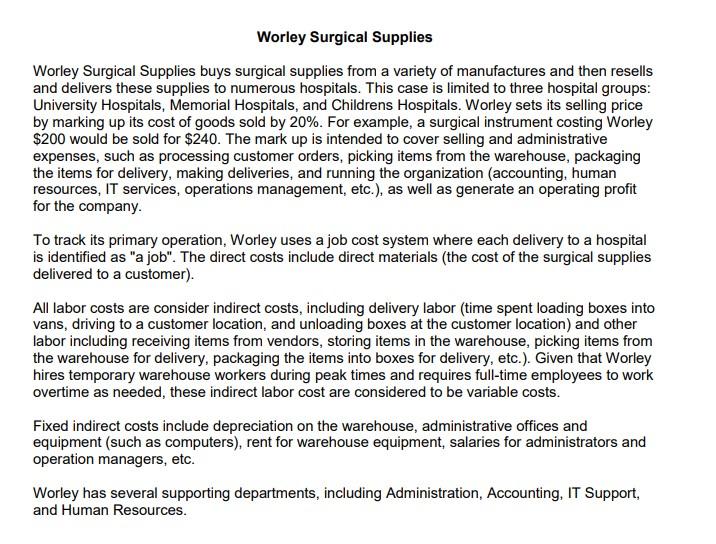

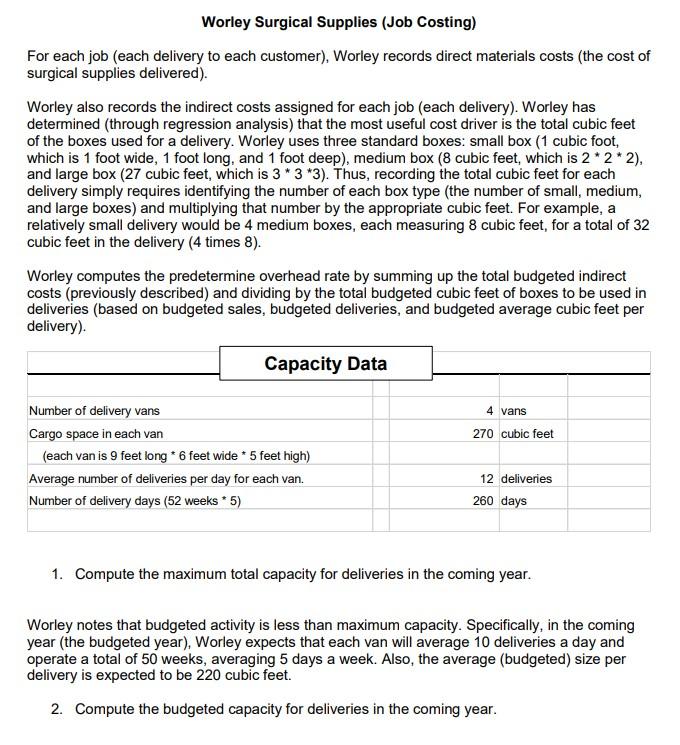

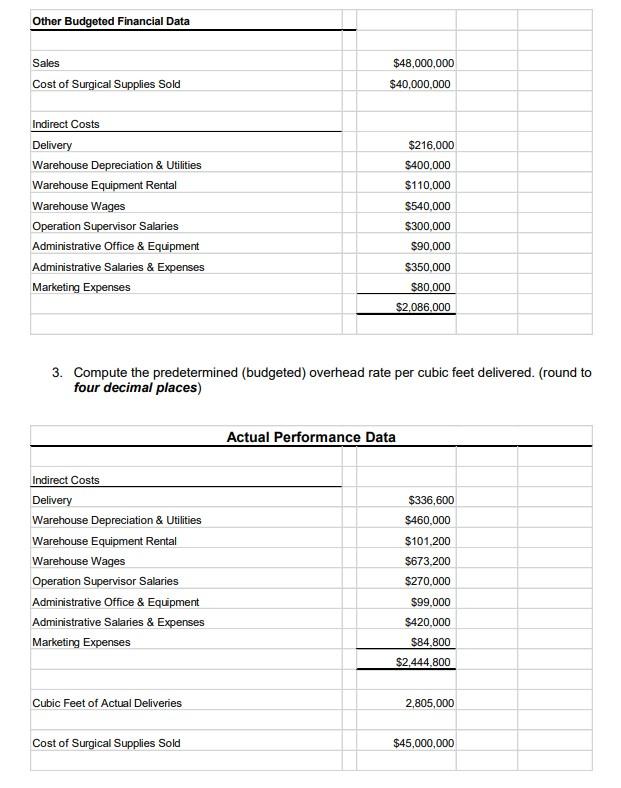

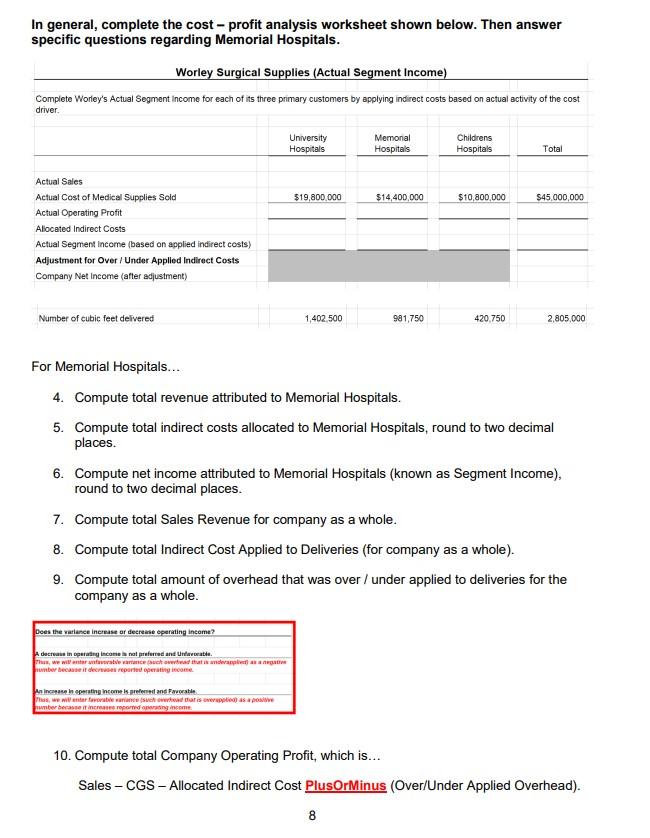

Worley Surgical Supplies Worley Surgical Supplies buys surgical supplies from a variety of manufactures and then resells and delivers these supplies to numerous hospitals. This case is limited to three hospital groups: University Hospitals, Memorial Hospitals, and Childrens Hospitals. Worley sets its selling price by marking up its cost of goods sold by 20%. For example, a surgical instrument costing Worley $200 would be sold for $240. The mark up is intended to cover selling and administrative expenses, such as processing customer orders, picking items from the warehouse, packaging the items for delivery, making deliveries, and running the organization (accounting, human resources, IT services, operations management, etc.), as well as generate an operating profit for the company. To track its primary operation, Worley uses a job cost system where each delivery to a hospital is identified as "a job". The direct costs include direct materials (the cost of the surgical supplies delivered to a customer). All labor costs are consider indirect costs, including delivery labor (time spent loading boxes into vans, driving to a customer location, and unloading boxes at the customer location) and other labor including receiving items from vendors, storing items in the warehouse, picking items from the warehouse for delivery, packaging the items into boxes for delivery, etc.). Given that Worley hires temporary warehouse workers during peak times and requires full-time employees to work overtime as needed, these indirect labor cost are considered to be variable costs. Fixed indirect costs include depreciation on the warehouse, administrative offices and equipment (such as computers), rent for warehouse equipment, salaries for administrators and operation managers, etc. Worley has several supporting departments, including Administration, Accounting, IT Support, and Human Resources. Worley Surgical Supplies (Job Costing) For each job (each delivery to each customer), Worley records direct materials costs (the cost of surgical supplies delivered). Worley also records the indirect costs assigned for each job (each delivery). Worley has determined (through regression analysis) that the most useful cost driver is the total cubic feet of the boxes used for a delivery. Worley uses three standard boxes: small box (1 cubic foot, which is 1 foot wide, 1 foot long, and 1 foot deep), medium box (8 cubic feet, which is 2 * 2 * 2), and large box (27 cubic feet, which is 3*3*3). Thus, recording the total cubic feet for each delivery simply requires identifying the number of each box type (the number of small, medium, and large boxes) and multiplying that number by the appropriate cubic feet. For example, a relatively small delivery would be 4 medium boxes, each measuring 8 cubic feet, for a total of 32 cubic feet in the delivery (4 times 8). Worley computes the predetermine overhead rate by summing up the total budgeted indirect costs (previously described) and dividing by the total budgeted cubic feet of boxes to be used in deliveries (based on budgeted sales, budgeted deliveries, and budgeted average cubic feet per delivery) Capacity Data 4 vans 270 cubic feet Number of delivery vans Cargo space in each van (each van is 9 feet long * 6 feet wide * 5 feet high) Average number of deliveries per day for each van. Number of delivery days (52 weeks * 5) 12 deliveries 260 days 1. Compute the maximum total capacity for deliveries in the coming year. Worley notes that budgeted activity is less than maximum capacity. Specifically, in the coming year (the budgeted year), Worley expects that each van will average 10 deliveries a day and operate a total of 50 weeks, averaging 5 days a week. Also, the average (budgeted) size per delivery is expected to be 220 cubic feet. 2. Compute the budgeted capacity for deliveries in the coming year. Other Budgeted Financial Data Sales Cost of Surgical Supplies Sold $48,000,000 $40,000,000 Indirect Costs Delivery Warehouse Depreciation & Utilities Warehouse Equipment Rental Warehouse Wages Operation Supervisor Salaries Administrative Office & Equipment Administrative Salaries & Expenses Marketing Expenses $216,000 $400,000 $110,000 $540,000 $300,000 $90,000 $350,000 $80.000 $2,086.000 3. Compute the predetermined (budgeted) overhead rate per cubic feet delivered. (round to four decimal places) Actual Performance Data Indirect Costs Delivery Warehouse Depreciation & Utilities Warehouse Equipment Rental Warehouse Wages Operation Supervisor Salaries Administrative Office & Equipment Administrative Salaries & Expenses Marketing Expenses $336,600 $460,000 $101.200 $673,200 $270,000 $99,000 $420,000 $84,800 $2,444,800 Cubic Feet of Actual Deliveries 2,805,000 Cost of Surgical Supplies Sold $45,000,000 In general, complete the cost - profit analysis worksheet shown below. Then answer specific questions regarding Memorial Hospitals. Worley Surgical Supplies (Actual Segment Income) Complete Worley's Actual Segment income for each of its three primary customers by applying indirect costs based on actual activity of the cost driver. University Hospitals Memonal Hospitals Childrens Hospitals Total $19,800.000 $14,400,000 $10,800,000 $45,000,000 Actual Sales Actual Cost of Medical Supplies Sold Actual Operating Profit Alocated Indirect Costs Actual Segment Income (based on applied indirect costs) Adjustment for Over/Under Applied Indirect Costs Company Net Income (after adjustment) Number of cubic feet delivered 1,402.500 981,750 420.750 2,805,000 For Memorial Hospitals... 4. Compute total revenue attributed to Memorial Hospitals. 5. Compute total indirect costs allocated to Memorial Hospitals, round to two decimal places. 6. Compute net income attributed to Memorial Hospitals (known as Segment Income), round to two decimal places. 7. Compute total Sales Revenue for company as a whole. 8. Compute total Indirect Cost Applied to Deliveries (for company as a whole). 9. Compute total amount of overhead that was over / under applied to deliveries for the company as a whole. Does the variance increase or decrease operating income? decrease in operating income preferred and latte Thus, we want to wartanewadiadau umber because it decreases reported operating income Janincasse peating income spretand Fawati Thes, we will ableware wat is verplich se we hecat increased 10. Compute total Company Operating Profit, which is... Sales - CGS - Allocated Indirect Cost PlusOrMinus (Over/Under Applied Overhead). 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts