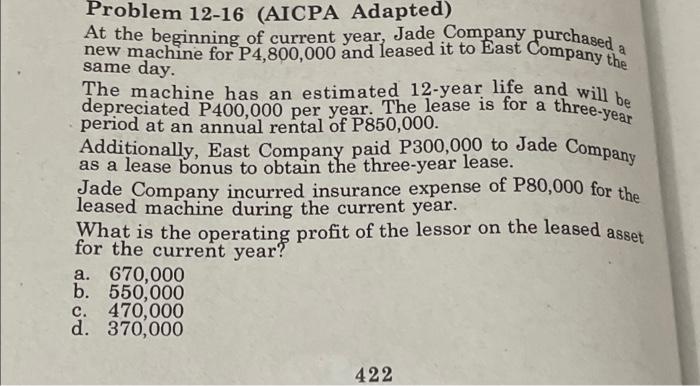

Question: Please answer 12-16 and 12-17 a three-year Problem 12-16 (AICPA Adapted) new machine for P4,800,000 and leased it to East Company the At the beginning

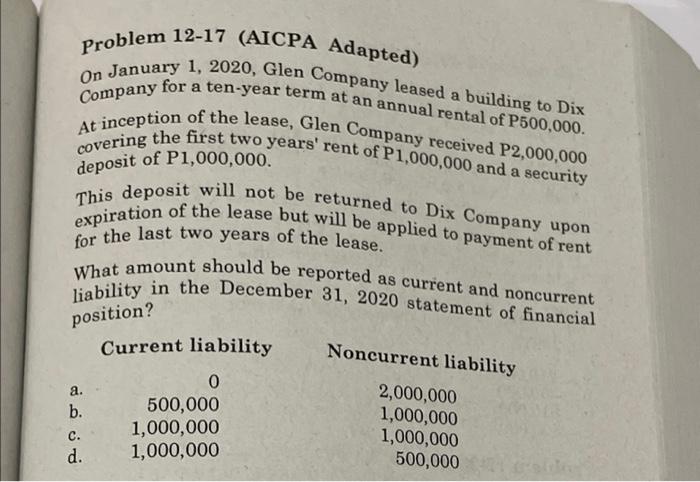

a three-year Problem 12-16 (AICPA Adapted) new machine for P4,800,000 and leased it to East Company the At the beginning of current year, Jade Company purchased same day. The machine has an estimated 12-year life and will be depreciated P400,000 per year. The lease is for a period at an annual rental of P850,000. Additionally, East Company paid P300,000 to Jade Company as a lease bonus to obtain the three-year lease. Jade Company incurred insurance expense of P80,000 for the leased machine during the current year. What is the operating profit of the lessor on the leased asset for the current year? a. 670,000 b. 550,000 c. 470,000 d. 370,000 422 Problem 12-17 (AICPA Adapted) On January 1, 2020, Glen Company leased a building to Dix Company for a ten-year term at an annual rental of P500,000. At inception of the lease, Glen Company received P2,000,000 covering the first two years' rent of P1,000,000 and a security This deposit will not be returned to Dix Company upon expiration of the lease but will be applied to payment of rent for the last two years of the lease. What amount should be reported as current and noncurrent liability in the December 31, 2020 statement of financial position? Current liability Noncurrent liability a. b. c. d. 0 500,000 1,000,000 1,000,000 2,000,000 1,000,000 1,000,000 500,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts