Question: Please answer 18 Gradebook Email Live Doc Sharing Dropbox Journal WebliographyTech Support 18. Assuming that there were no finandng cash flows during 2017 and basing

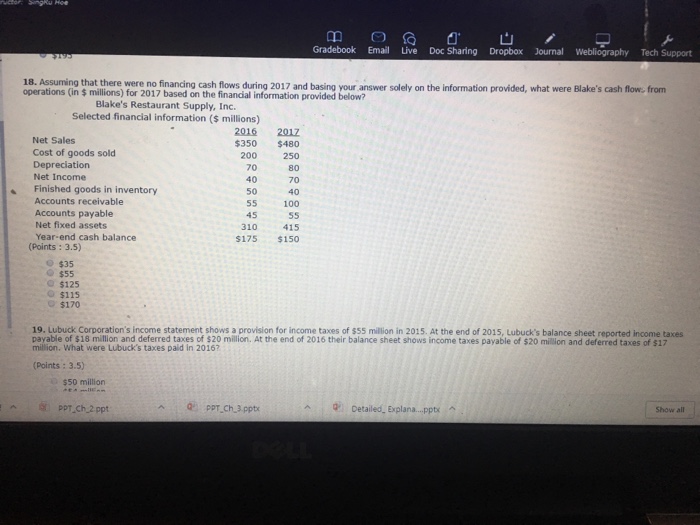

Gradebook Email Live Doc Sharing Dropbox Journal WebliographyTech Support 18. Assuming that there were no finandng cash flows during 2017 and basing your answer solely on the information provided, what were Blake's cash flow: from operations (in $ millions) for 2017 based on the financial information provided below? Blake's Restaurant Supply, Inc. Selected financial information (S millions) Net Sales Cost of goods sold Depreciation Net Income 2016 2017 $350 $480 200 250 40 80 So 70 70 Finished goods in inventory Accounts receivable Accounts payable Net fixed assets Year-end cash balance 40 100 S5 45 310 415 $175 $150 (Points: 3.5) $35 $55 $125 $115 $170 19. Lubuck Corporation's income statement shows a provision for income taxes of $55 million in 2015. At the end of 2015, Lubuck's balance sheet reported income taxes payable of $18 million and deferred taxes of $20 million. At the end of 2016 their balance sheet shows income taxes payable of $20 million and deferred taxes of $17 million. What were Lubuck's taxes pald in 20167 (Points : 3.5) $50 million PPT Ch 2 ppt pPT Ch3 ppt Detailed, Explana...ptx Show all

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts