Question: Please answer 7, 8, 9, & 10. Gradebook Email Live Doc Sharing Dropbox Journal Webliography Tech Support Help 7. Continued from question 6, the currency

Please answer 7, 8, 9, & 10.

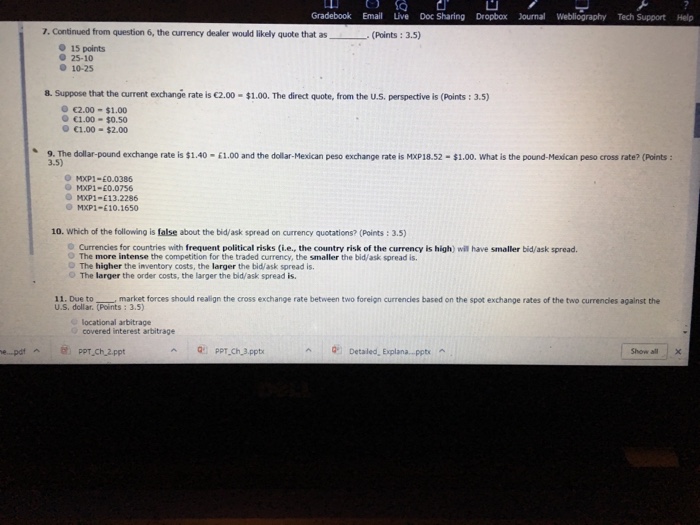

Please answer 7, 8, 9, & 10. Gradebook Email Live Doc Sharing Dropbox Journal Webliography Tech Support Help 7. Continued from question 6, the currency dealer would likely quote that as(Points: 3.5) 15 points 0 25-10 0 10-25 8. Suppose that the current exchange rate is C2.00-$1.00. The direct quote, from the u.S. perspective is (Points:3.5) 0 2.00-$1.00 1.00-$0.50 1.00-$2.00 9. The dollar-pound exchange rate is $1.40-61.00 and the dollar-Mexican peso exchange rate is MXP18.52-$1.00. What is the pound-Mexican peso cross rate? (Points: 3.5) O MXP1-0.0386 MXP1-0.0756 OMXP1-13.2286 MXP1-E10.1650 10. Which of the following is false about the bid/ask spread on currency quotations? (Points:3.5) Currencies for countries with frequent political risks (i.e., the country risk of the currency is high) will have smaller bid/ask spread O The more intense the competition for the traded currency, the smaller the bid/ask spread is O The higher the inventory costs, the larger the bid/ask spread is The larger the order costs, the larger the bid/ask spread is. 11. Due to market forces should realign the cross exchange rate between two foreign currencies based on the spot exchange rates of the two currendies against the U.S. dollar. (Points : 3.5) locational arbitrage covered interest arbitrage pdfPPT Ch 2.ppt Detaled. Explana-pptx Show allx ^

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts